BSP to tighten watch on banks’ risky assets

MANILA, Philippines—With the continued rise of liquidity in the economy, which had pushed the Philippine Stock Exchange Index above 7,000 points, the Bangko Sentral ng Pilipinas is considering imposing stricter underwriting standards and higher capital requirements to cover risky assets held by banks.

Although developments indicating that the capital markets will remain vibrant are welcome, the BSP said it was mindful of the need to temper asset price inflation to ensure that the country’s favorable economic performance would not be disrupted.

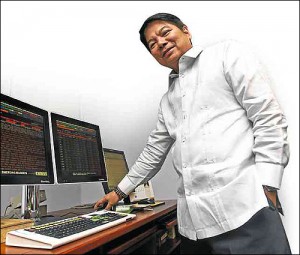

BSP Governor Amando Tetangco Jr. said the central bank wanted the banking system to help in channeling more funds to job-generating and long-term investments, rather than short-term income opportunities.

“Our objective is to create a lasting behavioral change in the market, encourage a longer-term perspective among market participants rather than short-term opportunistic punting. Such a long-term perspective can strengthen the base for solid economic growth,” Tetangco told the Inquirer.

According to Tetangco, the BSP is reviewing the exposure of banks to various assets—both real estate and financial instruments that are deemed risky.

The results of the review, Tetangco said, would be used to determine necessary adjustments in the capital requirements for and changes in the limits in the exposure to certain assets. The BSP may also issue standards on underwriting to help ensure that banks and the public are properly guided in making investment decisions.

“The information we gather will (aid in undertaking) any adjustments to percentage exposures of banks to the real estate sector or changes in risk weights of specific exposures to asset markets, and in advising banks on better grounded and informed underwriting standards,” Tetangco added.

At present, banks are required to limit their real estate exposure at not more than 20 percent of their loan portfolios. The term “real estate exposure” currently covers only loans extended to commercial real estate developers.

The BSP is considering adjusting the 20-percent limit and expanding the coverage of real estate exposure to also include housing loans to individuals, loans to developers of socialized houses and banks’ holdings of securities issued by real estate firms.