PH salvation lies in export sector dev’t, says BSP

The Bangko Sentral ng Pilipinas wants an export sector development agenda drawn up to ensure that the country’s foreign exchange reserves remain at a healthy level in the face of worsening global economic conditions.

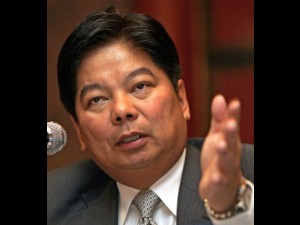

According to BSP Governor Amando Tetangco Jr., boosting the export sector’s competitiveness will reduce the country’s dependence on remittances as source of foreign currencies.

To develop the export sector, Tetangco said, private firms are highly encouraged to invest more in research and development of new products that the Philippines can competitively sell in the global market.

“There have been concerns that the Philippines may be over-reliant on remittances from overseas Filipinos in terms of financing its foreign exchange needs,” Tetangco said in a speech last week during a gathering of Chinese-Filipino businessmen.

It is important, he said, “to promote a sustainable external position” by increasing investments in the export sector.

Article continues after this advertisementThe country currently has about $84 billion in foreign exchange reserves—more than enough to cover nearly a year’s worth of the country’s import requirements, the BSP said, citing international benchmarks.

Article continues after this advertisementRemittances, which amounted to about $21 billion last year, would continue to provide a steady stream of foreign exchange liquidity for the Philippines, Tetangco said.

But he stressed that the country could become more resilient to external shocks if it could strengthen other sources of foreign exchange.

Currently, the Philippines relies heavily on electronics for its export revenue. Electronics—mainly intermediate goods that serve as inputs to consumer products like cellular phones and computers—account for at least half of the country’s export earnings.

The trade in electronics is considered highly vulnerable to the economic conditions of export markets. This is because, in a time of crisis, people tend to focus spending on basic needs and reduce the purchase of non-essentials, economists explained.

In 2011, the Philippines suffered a contraction in export earnings due to the economic problems of the United States and the euro zone. The BSP believes it is high time for the country to develop new products that can be exported and enhance those that are now being shipped out to drum up demand.

The country’s total export revenue in 2012 almost came to $52 billion, up by 7.6 percent year on year. The growth rate fell short of the government’s target of 10 percent, but was still a stark improvement from the contraction seen in 2011.

Also, some traders claim that the strengthening of the peso has led to the decline in the country’s export earnings.

The peso’s appreciation has made Philippine goods more expensive to foreign buyers and, therefore, less competitive in the global market, the said.

But the BSP said that the export sector should not bank on the exchange rate to be competitive.

Exporters must strive to become more efficient and competitive by enhancing products for exports, while searching for other export markets, the regulator said.

The BSP has already implemented several measures, such as the purchase of more dollars, to prevent the peso from appreciating too sharply.

But the regulator added that it still maintained a policy of letting the market determine the exchange rate. This is because, while a weak peso benefits the export sector, it also makes imported goods more expensive, among other disadvantages, the BSP said.