Philippines to flaunt gains at ADB meeting

The Philippines, host to this year’s annual meetings of the Asian Development Bank, will flaunt the reforms it instituted over the past decade and the resulting macroeconomic achievements when delegates from various countries meet for the high-profile event.

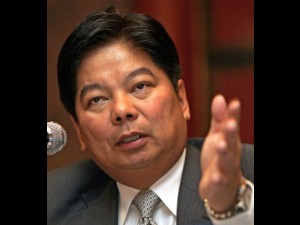

Governor Amando Tetangco Jr. of the Bangko Sentral ng Pilipinas said the meetings, to be held in Manila from May 2 to 5, are an opportunity for countries to share knowledge that could aid in economic development, and the Philippines is poised to share its own humble, success stories.

“We will be able to demonstrate the positive effects of the reforms that we have implemented over the years and how these have helped bring our economy to growth,” Tetangco told reporters.

The Philippines, although still confronted with problems on poverty and low foreign investments, is cited for having continually posted economic growth even at the height of the last global economic crisis in 2009. While most advanced economies and some emerging markets fell into recession that year, the Philippine managed to post a modest growth rate.

Private firms and the country’s national government also were not significantly affected by the global crisis. Corporate profits, including those of the banking sector, remained healthy and the government remained able to tap international capital markets to raise funds at interest rates deemed reasonable.

Article continues after this advertisementBSP officials said that most crucial reforms in the country were those involving the banking sector, which significantly strengthened over the years after being hardly hit during the Asian financial crisis of the late 1990s.

Article continues after this advertisementRegulatory reforms for the banking sector included adoption of prudent lending and risk-taking standards, tax incentives for sale of bad debts, and capitalization buildup, among others.

BSP officials said sound investment policies of Philippine banks kept them from investing heavily in foreign currency-denominated derivatives, investments in which led to financial problems for many firms in advanced economies.

Tetangco also said the Philippines may contribute knowledge on maintaining a benign inflation environment, which hinges on prudent management of liquidity within the economy.

On the fiscal front, officials said the Philippine government’s ability to reduce its debt burden from a peak in 2004, when the government was said to be on a brink of a fiscal crisis, is another key achievement of the country.

The country’s debt-to-GDP ratio hit a high of 78 percent in 2004, but is now down to close to 50 percent. The existing level is considered manageable based on international standards.

Debt-to-GDP ratio is the proportion of the combined debts of the government and the private sector to the country’s gross domestic product.