Asian shares rise, Shanghai soars on China easing hopes

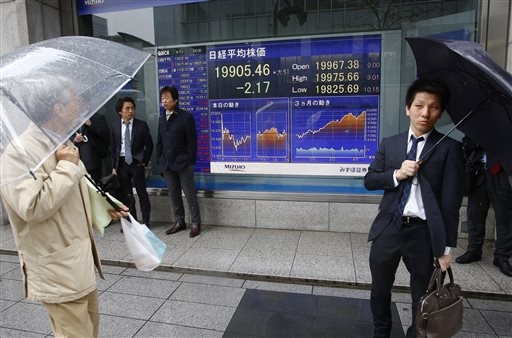

A man watches an electronic stock indicator of a securities firm in Tokyo on April 13, 2015. Asian markets rose Thursday, April 16, with Shanghai rallying on hopes for further China stimulus while Japanese shares were boosted by a weaker yen as the dollar reversed earlier losses. AP PHOTO/SHIZUO KAMBAYASHI

HONG KONG–Asian markets rose Thursday, with Shanghai rallying on hopes for further China stimulus while Japanese shares were boosted by a weaker yen as the dollar reversed earlier losses.

The gains follow a positive lead from Wall Street, where another batch of weak figures was offset by a pick-up in oil prices, an upbeat Federal Reserve economic report and hopes for lower rates for a little longer.

Shanghai surged 2.71 percent, or 110.66 points, to 4,194.82 and Hong Kong gained 0.44 percent, or 120.89 points, to 27,739.71.

Tokyo bounced from a morning sell-off to end slightly higher, gaining 16.01 points to 19,885.77.

Sydney advanced 0.66 percent, or 39.08 points, to close at 5,947.5 after a better-than-expected unemployment reading for March, while Seoul rose 0.94 percent, or 19.94 points, to 2,139.90.

Hong Kong’s bourse continued its rally after soaring over the past week with record turnover as mainland investors look for cheap assets in the city following a year-long rally in Shanghai that almost doubled its value.

Chinese investors have been flooding into stocks–using a link-up between the Hong Kong and Shanghai exchanges–on expectations China will ramp up its stimulus program to support the struggling economy, which in January-March grew at its slowest pace in six years.

On foreign exchange markets the dollar edged to 119.34 yen from 119.14 yen in New York. It had fallen below 119 yen at one point Thursday after the release in Washington of more weak data.

US industrial production fell 0.6 percent in March, according to the Fed, twice the decline projected by analysts. Also, the New York Fed said its Empire State index on manufacturing activity plunged into negative territory in April for the first time since December.

The data came on the heels of a disappointing US retail sales report that had dented the dollar on Tuesday.

The dollar has fallen back in the past few days as soft US figures narrow the chances the Fed will hike interest rates soon. Expectations earlier in the year had been for a rise as early as June as the economy showed signs of strength.

June US rate hike unlikely

Sharon Zollner, a senior economist in Auckland at ANZ Bank New Zealand, wrote in a client note: “A June start to interest-rate normalization is looking ever more unlikely.”

However, there was some good news in the Fed’s Beige Book report, a snapshot of economic conditions, which gave a positive outlook on growth and an improving labor market.

On Wall Street the Dow rose 0.42 percent, the S&P 500 added 0.51 percent and the Nasdaq climbed 0.68 percent.

The euro bought $1.0635 and 127.00 yen against $1.0684 and 127.29 yen in US trade.

The single currency has been weighed down by the European Central Bank’s new bond-buying stimulus program.

On Wednesday it voted to keep interest rates at their current all-time lows, as expected, and rejected speculation of an early end to its quantitative easing policy. ECB chief Mario Draghi said the scheme was working.

Australia’s dollar edged up half a cent to 77.77 US cents Thursday after figures showed the country’s jobless rate eased one 0.1 percentage point to 6.1 percent last month. The news beat a forecast of 6.3 percent and is seen by some as lowering the chances of another interest rate cut in the near term.

In oil trade US benchmark West Texas Intermediate (WTI) for May delivery eased 38 cents to $56.01 while Brent crude for June slipped 78 cents to $62.54 in afternoon trade.

On Wednesday WTI jumped $3.10 to $56.39, its highest closing price since December 23, while Brent crude for May shot up $1.89 to $60.32 on its last day of trading.

Gold fetched $1,208.60 against $1,191.19 late Wednesday.

In other markets:

— Bangkok rose 1.43 percent, or 22.17 points, to 1,570.00

Bumrungrad Hospital gained 1.97 percent to 155 baht, while Airports of Thailand climbed 2.39 percent to 300 baht.

— Singapore fell 0.24 percent, or 8.34 points, to close at 3,531.61.

Singapore Airlines declined 1 percent to Sg$11.90 while Singapore Telecom fell 1.77 percent to Sg$4.45.

— Malaysia’s main index gained 0.42 percent, or 7.81 points, to close at 1,847.94.

Maybank added 1.18 percent to 9.45 ringgit, Sime Darby rose 0.54 percent to 9.27 while RHB Capital lost 0.13 percent to 7.88 ringgit.

— Jakarta ended up 0.11 percent, or 6.19 points, at 5,420.73.

Telecommunication infrastructure firm Tower Bersama Infrastructure gained 1.34 percent to 9,425 rupiah, while coal miner Indo Tambangraya Megah slipped 2.10 percent to 15,125 rupiah.

— Mumbai fell 0.46 percent, or 133.65 points, to end at 28,666.04.

Motorbike maker Hero Motorcorp fell 3.76 percent to 2,428.85 rupees, while Oil & Natural Gas Corporation rose 3.25 percent to 327.50 rupees.

— Taipei added 1.22 percent, or 116.81 points, to 9,656.87.

Taiwan Semiconductor Manufacturing Co. gained 2.80 percent to Tw$147.0 while Hon Hai Precision Industry closed 1.30 percent higher at Tw$93.3

— Wellington rose 0.44 percent, or 26.68 points, to 5,881.76.

Telecom firm Spark gained 0.51 percent to NZ$2.93 and Trade Me was up 1.90 percent at NZ$3.75.

— Manila closed 0.53 percent higher, adding 41.74 points to 7,948.20.

Universal Robina Corp. rose 2.34 percent to 219 pesos and Metropolitan Bank and Trust Co. fell 0.31 percent to 96.90 pesos.