China industrial output jumps to five-month high

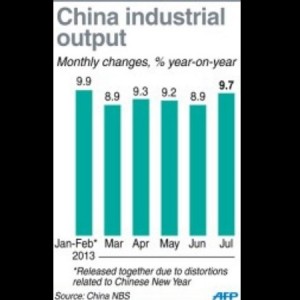

CHINA : Graphic charting China’s industrial output, which jumped to a five-month high in July, official data showed Friday. AFP

BEIJING – China’s key industrial production growth accelerated to a five-month high in July, the government announced Friday as a series of statistics gave positive pointers for the world’s second-largest economy.

Industrial production, which measures output at factories, workshops and mines, rose 9.7 percent year-on-year, well above analyst expectations of 9.0 percent in a survey by Dow Jones Newswires.

Authorities also announced steady expansion in retail sales and fixed asset investment, and a benign inflation figure of 2.7 percent, unchanged on last month.

Analysts said the figures pointed to a more stable outlook for China’s economy – seen as a key driver of global growth – after months of mounting pessimism.

Lu Ting, a Hong Kong-based economist for Bank of America Merrill Lynch, told AFP the “overall figures are actually very good, especially the industrial output figure.”

Gross domestic product (GDP) in China – seen as a key driver of global growth – expanded 7.8 percent in 2012, its slowest annual pace in 13 years.

Growth slipped to 7.7 percent in the January-March period and slowed further to 7.5 percent in the second quarter, raising alarm bells among economists over possible further weakness.

But after Friday’s figures Lu told AFP: “The momentum, if maintained, would in fact make everyone’s estimation about the second half rather pessimistic, so we will likely see a round of GDP forecast upgrades soon.”

The output figures came on the heels of robust trade figures Thursday.

Exports and imports, which had contracted in June, rebounded in July, growing 5.1 percent and 10.9 percent year-on-year respectively, according to Customs.

Two-way trade rose 7.8 percent year-on-year, slightly lower than the government’s eight percent target for this year but “showing a stabilizing and recovering trend,” Customs said.

July’s output growth figure was higher than June’s 8.9 percent and marked the best performance since the 9.9 percent recorded for January and February, which were released together due to distortions related to Chinese New Year.

Separately, retail sales, a key indicator for consumer spending, rose 13.2 percent in July compared with the same month last year, the NBS said, only a marginal slowing from 13.3 percent in June.

Growth in fixed asset investment, a key measure of government spending on infrastructure, increased 20.1 percent during the first seven months of this year compared with the same period in 2012, the NBS said, unchanged on last month’s rate.

Earlier Friday, the NBS said that inflation held steady at 2.7 percent year-on-year in July, a result seen as potentially giving the authorities some leeway to take measures to boost the economy if needed.

The consumer price index (CPI) rise was marginally below market expectations of 2.8 percent, according to the Dow Jones survey. The CPI reading – a main gauge of inflation – has broadly eased since hitting 3.2 percent in February during the Chinese New Year holiday, although it rebounded in June to a four-month high.