Philippine stocks succumb anew to profit-taking

MANILA, Philippines—Local stocks tumbled on profit-taking for the second day on Wednesday as global growth woes dampened trading across regional markets.

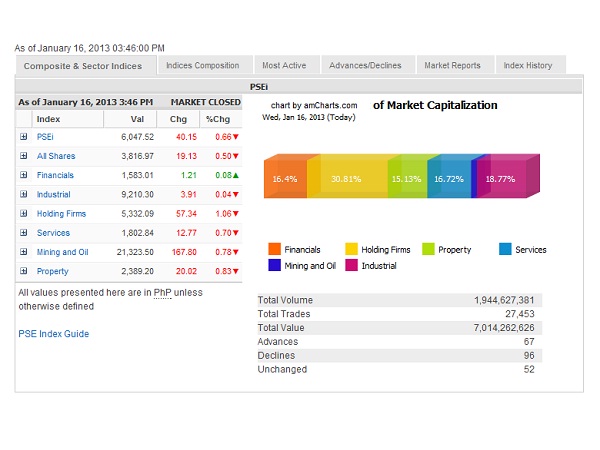

The main-share Philippine Stock Exchange Index shed 40.15 points, or 0.66 percent, to finish at 6,047.52. This was in line with the weak sentiment across the region after the World Bank slashed its global growth forecast further to 2.4 percent this year from an earlier outlook of 3 percent.

At the local market, all counters ended in negative territory except for the financial index.

The top index decliners were JG Summit, Philex, RLC, ICTSI, Metro Pacific Investments and Meralco, which all fell by over 2 percent.

Philex was down by 2.82 percent on reports that the government rejected its appeal on the P1-billion penalty arising from the Padcal mine tailing pond leakage.

JG Summit and RLC, which last month struck a gaming partnership deal with Japanese tycoon Okada, were affected by news over a Federal Bureau of Investigation probe on the latter’s Philippine casino permit.

Meralco, BDO, AEV, AC, DMCI and Metrobank also contributed to the index decline, all of them falling by over 1 percent. PLDT, Globe, SMIC, Metrobank, ALI, URC and SM Prime also fell.

On the other hand, the decline was tempered by the gains of Jollibee, BPI, AGI, EDC, SMDC, AP, MWC, Petron, Megaworld and Semirara.

Across the region, stock markets were mostly lower as the World Bank issued its latest world economic outlook. “Four years after the onset of the global financial crisis, the world economy continues to struggle. Developing economies are still the main driver of global growth, but their output has slowed. To regain pre-crisis growth rates, developing countries must once again emphasize internal productivity-enhancing policies. While headwinds from restructuring and fiscal consolidation will persist in high-income countries, these should become less intense allowing for a slow acceleration in growth over the next several years,” the bank said.