How mobile load purchases can get you that big loan

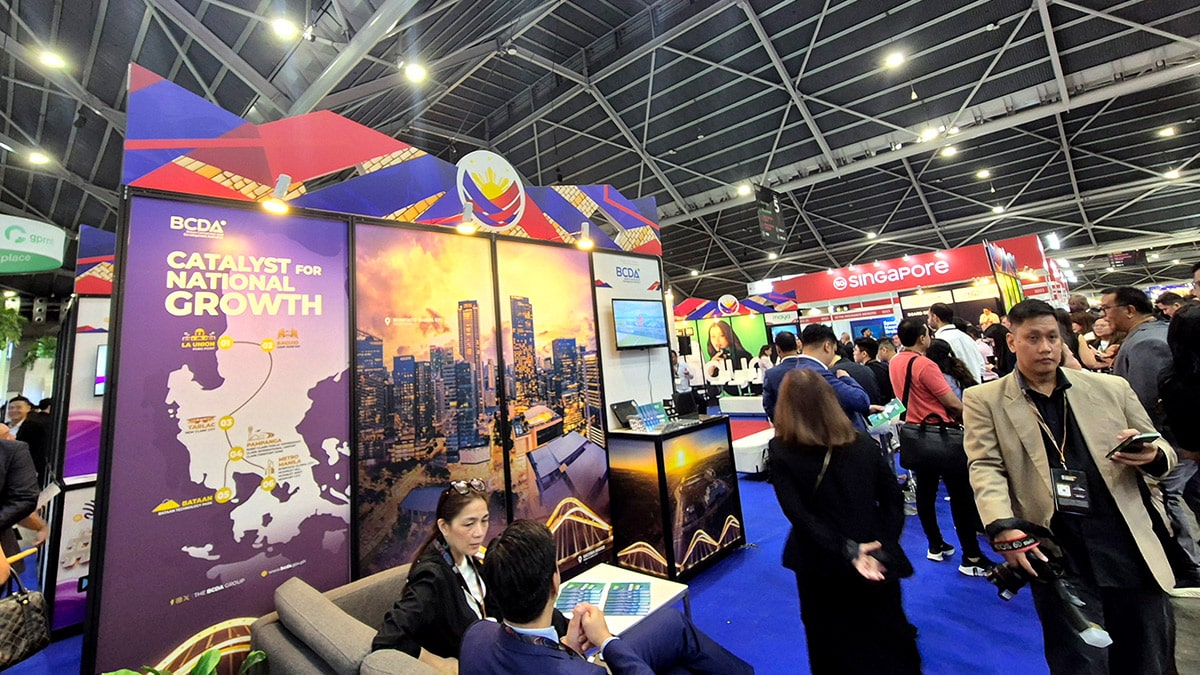

TECH CARAVAN FinTech Alliance PH, government agencies and financial institutions showcase the Philippine Pavilion during the Singapore Fintech Festival this month.

In a country where smaller businesses find it challenging to obtain formal loans, financial technology (fintech) players have stepped up to extend credit to help them grow their operations.

FinTech Alliance PH founding chair Lito Villanueva, in an interview with the Inquirer, notes micro-, small- and medium- enterprises (MSMEs) have been resorting to predatory lenders due to lack of access to bank loans.

He says fintech players want to put a stop to this practice by developing financial products to give MSMEs cheap, yet legitimate options.

“The fintech industry has really contributed immensely to the expansion of access to credit, especially for MSMEs,” he says.

In traditional banking, borrowers are required to submit several documents during the loan application process, which include credit history. But not everyone has financial reports to prove their capacity to pay back the loan, thus hindering them from applying for a bank loan.

Article continues after this advertisementCredit profiling

Villanueva says this is something their industry has been addressing specifically.

Article continues after this advertisementBy looking into one’s payment behavior through the borrowers’ monthly bill payments, for example, fintech operators can already establish a credit profile, he says. This means they can have a basis for underwriting a loan that will suit the needs of borrowers.

Microsoft Philippines chief technology officer Lope Doromal Jr. agrees that using alternative data like bill payment transactions can boost access to lending, especially for MSMEs.

Another example is how often the borrower purchases mobile load for his or her cellular phone.

“Theoretically, it can give an idea how regular is the income of this person,” he tells the Inquirer.

Financial institutions, through technology such as artificial intelligence (AI), can make use of alternative data to extend loans, Doromal says.

“Access to capital is a big issue for a lot of MSMEs. If this works, then this would facilitate providing additional capital,” he says.

Human touch

Doromal, however, advises banks to be strategic when it comes to AI adoption, noting that human touch might still be necessary during initial implementation.

“Use the tool that still has a human person to vet the decision. Over time, as you become more confident that the AI model reflects what the bank wants to happen, then you can start automating things and so on,” he says.

In the Philippines, a study by global advisory firm Deloitte notes that 62 percent of surveyed business and technology leaders expressed “excitement” over the use of AI. But some respondents identified lack of technical talent and skills as the “biggest barrier” to AI adoption.

Protecting users

As more Filipinos become more comfortable using fintech applications, Protecta Pilipinas also reminded operators to step up their cybersecurity measures to safeguard users from potential fraud and hacking.

The multisectoral group comprising telecommunication players and government agencies has raised the need to prioritize security protocols like multifactor authentication and real-time fraud detection systems.

“Leveraging advanced technologies like artificial intelligence and machine learning can help proactively identify and mitigate threats, even as these same tools are used by cybercriminals,” Protecta Pilipinas convener Roy Ibay says.

The group also urges fintech players to always update users on the latest forms of financial scams. The industry must also share best online hygiene practices, it notes.

Lately, in the Philippines, hackers are resorting to sending text messages to random people offering job opportunities or cash prizes. These messages usually contain suspicious website links that will lead the victim into sharing his or her personal or financial profile. Hackers can then take over the person’s bank and e-wallet account to siphon money out.

According to an October 2024 report by Global Anti-Scam Alliance, Filipinos lost $8.1 billion, or nearly P460 billion, in the past 12 months due to scams that were mostly launched via text messages.

On average, Filipino victims each lost $275—or about P16,000—because of scams.

About 67 percent of the victims realized on their own that they had been scammed, the study notes. The rest needed to be told by a representative by a bank, telecommunication company or government to confirm the scam.

“By fostering a culture of vigilance and adherence to stringent security measures, the fintech industry can protect users and create a more resilient financial future for all Filipinos,” the group says.