The ripple effect of infrastructure on regional growth

Strategic investments in transportation, utilities, and urban planning shape real estate values, turning underutilized areas into prime locations for residential, commercial, and mixed-use developments.

These changes reflect the symbiotic relationship between infrastructure and property markets, wherein one fuels the other in a growth cycle.

Value multipliers

Roads, bridges, and railways have long proven their capacity to reshape the real estate landscape.

Improved connectivity reduces travel time and enhances accessibility, making areas more attractive for residential and commercial development. Highways, railways, and airports connect communities to economic centers, drastically improving accessibility and convenience.

By linking the metropolis more efficiently, properties near the proposed stations have already shown marked increases in demand.

Article continues after this advertisement

Water supply systems, power grids, and telecommunication networks provide the backbone for livable communities. (HTTPS://DENR.GOV.PH)

Expressways meanwhile demonstrate how road networks elevate areas previously perceived as secondary regions. They spur land appreciation in agricultural provinces and transform them into suburban havens.

Article continues after this advertisementThe combined effect of these expressways has attracted property developers to the area, resulting in a proliferation of industrial parks, residential subdivisions, and commercial centers.

Expressways demonstrate how road networks elevate areas previously perceived as secondary regions. (FILE PHOTO)

Foundation of real estate value

Water supply systems, power grids, and telecommunication networks provide the backbone for livable communities. When integrated into urban developments, these elements significantly enhance desirability.

Large-scale initiatives focus on self-sufficient urban ecosystems. (https://www.worldconstructiontoday.com)

Emerging cities have modernized their utility systems to support their growing economies. These improvements uplift surrounding properties. Reliable infrastructure has attracted developers to invest in projects that cater to the demands of an expanding urban population.

Airports, ecozones as game-changers

Airports and economic zones act as gateways for investment and commerce, driving growth in surrounding properties. Special economic zones amplify these effects by fostering job creation and industrial activity.

The Philippine Economic Zone Authority (PEZA) facilitates partnerships between government and developers to transform regions into productivity hubs. Properties near these zones experience rising demand as workers and businesses seek proximity to employment centers.

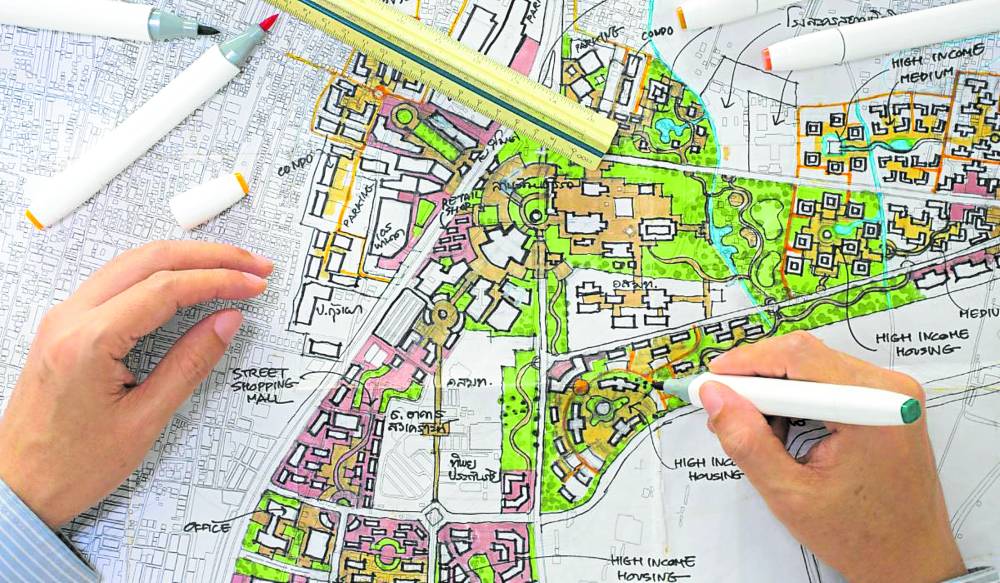

Strategic urban planning elevates property markets by promoting balanced development. (https://www.chitkara.edu.in)

Urban planning and sustainable growth

Strategic urban planning elevates property markets by promoting balanced development.

Large-scale initiatives focus on self-sufficient urban ecosystems, incorporating residential, commercial, and recreational spaces into cohesive masterplans. These developments prioritize sustainability, green spaces, and efficient transport systems, creating long-term value for property owners and investors.

Highways, railways, and airports connect communities to economic centers, drastically improving accessibility and convenience. (SAN MIGUEL CORP.)

Opportunities for investors

Long term value in real estate stems from a clear understanding of the broader trends in urbanization influenced by infrastructure.

Developers who align their projects with future upgrades, such as incorporating mixed-use developments near transit hubs, can better meet the evolving needs of a growing population. Areas prioritizing accessibility and proximity to essential infrastructure experience sustained demand, leading to consistent property appreciation over time.

By anticipating and adapting to infrastructure impacts, savvy investors position themselves at the forefront of real estate growth across the Philippines.

The author (www.ianfulgar.com) is a leading architect with an impressive portfolio of local and international clients. His team elevates hotels and resorts, condominiums, residences, and commercial and mixed-use township development projects. Ian’s innovative, cutting-edge design and business solutions have garnered industry recognition, making him the go-to expert for clients seeking to transform their real estate ventures