LG pitching ‘smart factory’ to the world

SEOUL, SOUTH KOREA — For nearly seven decades, industrial powerhouse LG has been manufacturing a wide array of household products. It produced Korea’s first TV, refrigerator and air conditioner in the 1960s. Also, and after the turn of the new millennium, LG made the world’s first washing machine with steam, the first ref with ice maker and water purifier and the first twin wash, among other game-changing milestones.

Originally founded as Goldstar Electronics in 1958 that rebranded as LG Electronics in 1995, this chaebol has since then scaled up to more than 60 factories that span four regions of the world, building more and more tools to make its multinational operations more competitive and efficient.

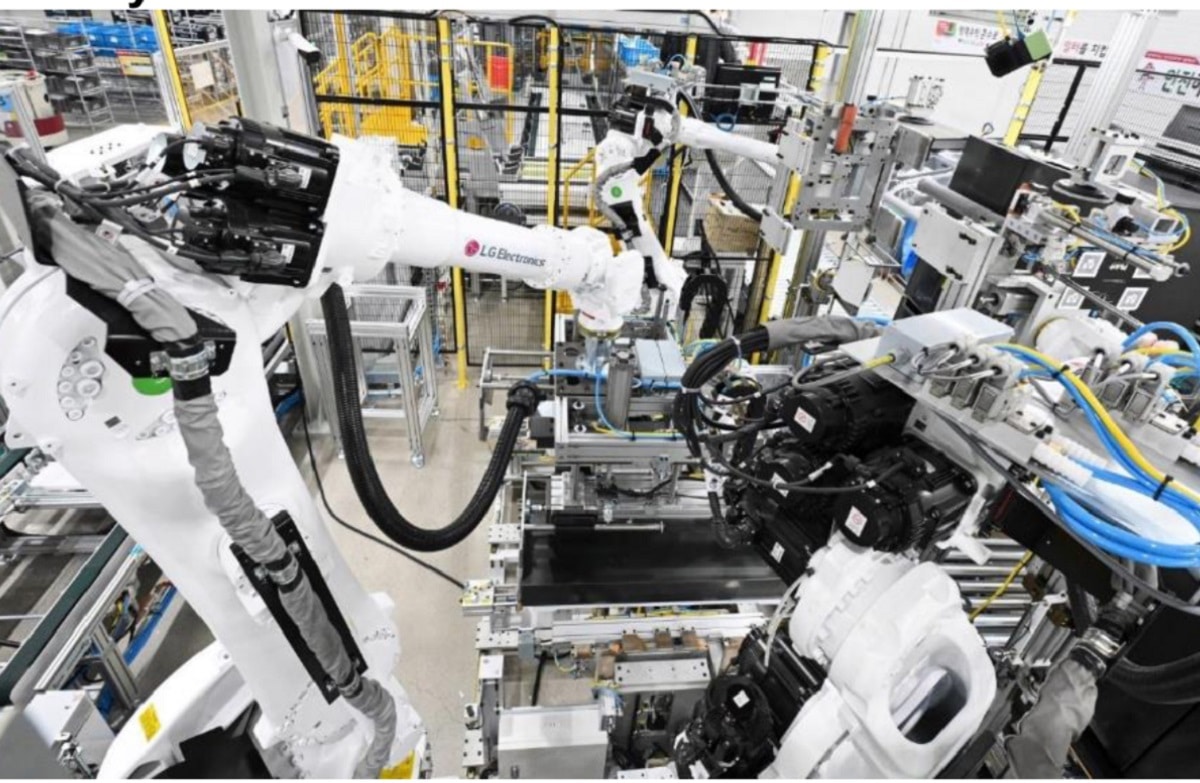

Having accumulated more than 1,000 patents for manufacturing solutions, even developing its own robots to automate repetitive tasks and harnessing artificial intelligence (AI) to identify operational problems even before they occur, LG has been setting up one “smart factory” after another, with the goal of raising output in a world where stability of labor, energy and supply chain stability is often at risk.

Recently, LG realized it’s sitting in a treasure chest of intangible assets just waiting to be monetized. What if it could create an entirely new business out of this rich expertise and knowhow in constructing and operating intelligent autonomous factories? What if instead of just making televisions, refrigerators, computers and other appliances it could enable other businesses to put up their own smart factories as well?

As a manufacturer itself, LG understands the whole journey—from strategic planning, design, implementation and even structuring a reliable supply chain—and now realizes it could create a new revenue stream by commercializing its whole gamut of smart factory construction technology and operational solutions.

Article continues after this advertisementLG did just that six months ago by establishing the smart factory division within its Production engineering Research Institute (PRI), supported by about 1,800 dedicated manufacturing research and development engineers. The home base is operated at LG Digital Park in the port city of Pyeongtaek, some 70 kilometers south of Seoul.

Article continues after this advertisementLG Digital Park, initially built in 1984 to produce LG video and audio products, now hosts the Smart Factory Acceleration Center where visitors can learn about its smart factory solutions.

On Tuesday, LG-PRI opened its doors to media representatives from around the world as it unveiled plans to debut into the global smart factory market as part of the expansion and diversification of its business-to-business portfolio.

Here, visitors can see robots the size of a coffee table top lifting racks. There are bigger automated mobile robots (AMRs) equipped with cameras, radars and sensors that can autonomously drive without bumping into anyone or anything. There’s the mobile manipulator, which looks like a robotic arm and capable of diverse tasks such as assembly, defect inspection and even replacing batteries of nearby AMRs.

Likewise showcased is its AI-driven inspection system, which keeps an eye on operating conditions at the factory and detects anomalies such as temperature fluctuations and defects. It also enhances factory safety management by flagging workers who are not properly wearing safety helmets or work vests.

This division also offers “digital twin” technology, which optimizes production logistics by recreating the environment in virtual reality, thereby simulating in real-time various scenarios and allowing the staff to anticipate and preemptively address issues. By analyzing data every 30 seconds, this can predict problems that are likely to occur within the next 10 minutes, such as a materials shortage on the production line. Based on its own data from 2020 to 2021, this technology has reduced defective product returns by 70 percent.

Off to a good start

Shi-Yong Song, head of LG Smart Factory Business, says in a press briefing that LG’s leadership in the manufacturing domain, combined with its unique experience and knowhow of the full manufacturing journey, means that it has accumulated, secured and fostered core technology essential for building a smart factory.

The business is very compelling for LG, he says, noting that the global market for a smart factory is hitting a compounded annual growth rate of 10 percent.

Although LG Smart Factory Business has embarked on this new business only recently, Song notes that as of the first half of this year, the division has won 20 external customers, with total volume of orders estimated to close the year at 300 billion Korean won ($230 million).

So far, the orders are mostly from those that manufacture battery, automotive parts and electric/electronic products, but Song adds that there are vast opportunities in semiconductors, food and beverage and biochemical manufacturing as well.

By going overseas, he says LG could be a “global leading player” and grow the business to the $1-billion level as manufacturers increasingly upgrade their capabilities to address lack of human labor and power as well as supply chain uncertainty and volatility.

Song says another selling point of LG is that two of its factories—LG Smart Park in Changwon, South Korea, and LG Tennessee factory in the United States—have been named as a “Lighthouse Factory” by the World Economic Forum. This means that the facilities are among those select sites across the world that exemplify the use of Internet of Things, big data, AI, robotics and other Fourth Industrial Revolution technology.

Dae-Hwa Jeong, president of LG PRI, estimates that the deals on the table—which so far involve local firms—require investments ranging between $10 million and $100 million in each factory.

Apart from helping with greenfield projects or factories that are built from scratch, it also aims to provide continuous improvement consulting services for factory upgrades.

“We try to run this as a general hospital. So we visit our customer site to see what it’s like, and try to provide the best solutions. That is where our business model is headed at the moment,” says Jeong.

But if this new division can build a smart factory for anyone in the world who can pay for it, could it end up enabling entities that can prospectively compete with other LG products?

Jeong explains how they can function as an independently operating organization.

“For example, LG Energy Solutions, which manufactures batteries, we try to raise their productivity, and sometimes our competitor or competing company might like to buy a product that they have manufactured. We try to work in a way that seeks collaboration, but at the same time does not infringe the IP (intellectual property) of LG Energy solutions.”

“While working with our partners and customers, especially when we have developed things together, we make sure that we gain their approval in the process as well,” adds Jeong. “And I think it’s not an issue of whether it’s LG or not LG Electronics. I think it’s an issue of who we cooperate with.”