Cloud on ground: The rise of data centers in PH

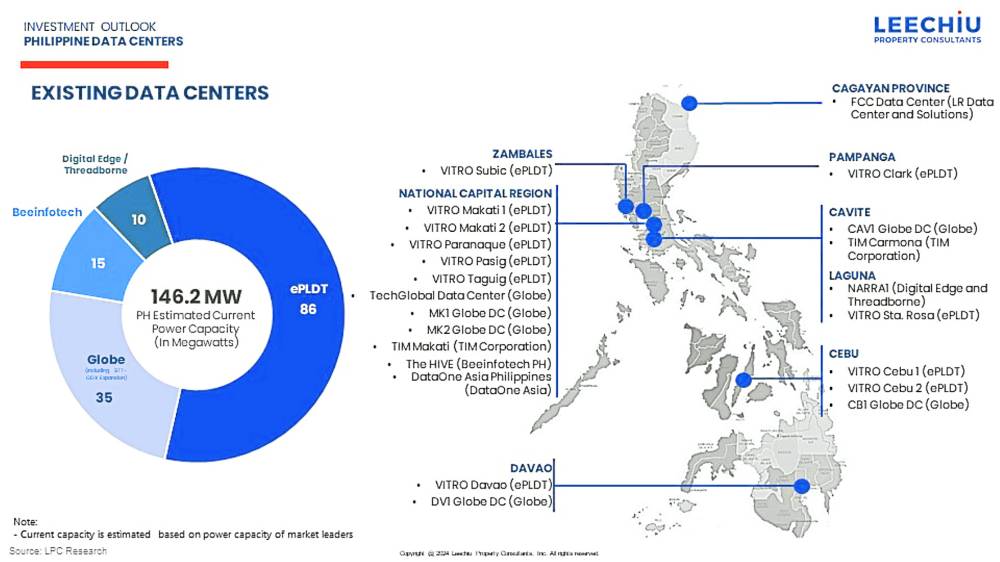

Existing data centers

As you scroll through your phone several times a day, have you ever wondered where all the data you exchange online gets stored?

While we often refer to it as the “cloud,” the reality is that our digital information is housed in specialized facilities known as data centers. These are essentially data warehouses, designed to securely store, process, and distribute vast amounts of information.

Surging demand

Data centers are equipped with racks of computer systems housed in multi-layered secure buildings, with redundant power supplies to prevent downtime and outages, and state-of-the-art HVAC systems to prevent overheating.

As our reliance on technology grows—especially with the rise of artificial intelligence (AI) and social media—robust infrastructure and data storage have become more essential than ever.

Over the past year, there has been a surge in inquiries and studies for data centers.

Article continues after this advertisementAccording to Research and Markets, the global data center market is estimated to have a capacity of 45,300 megawatts (MW) in 2024 and is expected to reach 71,980 MW by 2029, growing at a compound annual growth rate (CAGR) of 9.7 percent. Additionally, the industry is anticipated to generate colocation revenue of $127.14 billion in 2024.

Article continues after this advertisementAs of August 2024, the Philippines, with its population of about 119 million, has an estimated data center capacity of 146.2 MW—just a fraction of Singapore’s 1,400 MW, despite Singapore’s much smaller population of 5.6 million.

The construction and operation of data centers can generate a wide range of job opportunities, directly and indirectly.

Significant potential

Our current position offers significant potential for growth. In fact, several major hyperscale data center developers have already announced plans to build facilities in the country.

One of the most prominent is the planned Narra Technology Park in New Clark City, Tarlac. This project alone, with a total power capacity of 300 MW, is expected to triple the country’s current data center capacity.

Earlier this year, Manila Electric Co. (Meralco) revealed that it is processing over 30 service applications, totaling a capacity of 1,200 MW. Leechiu Property Consultants estimates that at least 1,382 MW of new data centers are in the pipeline, which will bring the country’s total data center power capacity to 1,528.2 MW.

Growth drivers

So, what is driving these data center developments in the Philippines?

Increasing need for storage space. One key factor is the global challenge of storing massive amounts of data generated by machine learning workloads and advanced AI systems, such as large language models (LLMs). As AI becomes increasingly integral to both work and daily life, this demand storage will continue to grow.

Data localization. Another factor is the global trend toward data localization, which restricts cross-border data transfers. Recently, neighboring countries like Indonesia and Vietnam have enacted laws that limit the cross-border processing and storage of personal data. While the Philippines has its own Data Privacy Act, its implementing rules and regulations still permit the transfer of personal information to foreign jurisdictions.

High internet usage. The Philippines has a young, tech-savvy population that consumes more time on the internet than the world average. According to datareportal.com, the Philippines boasts a staggering 86.98 million internet users, each contributing to the country’s thriving digital economy. Filipinos also spend an average of eight hours and 52 minutes online daily—two hours more than the global average of six hours and 42 minutes.

Potential as a major data center hub

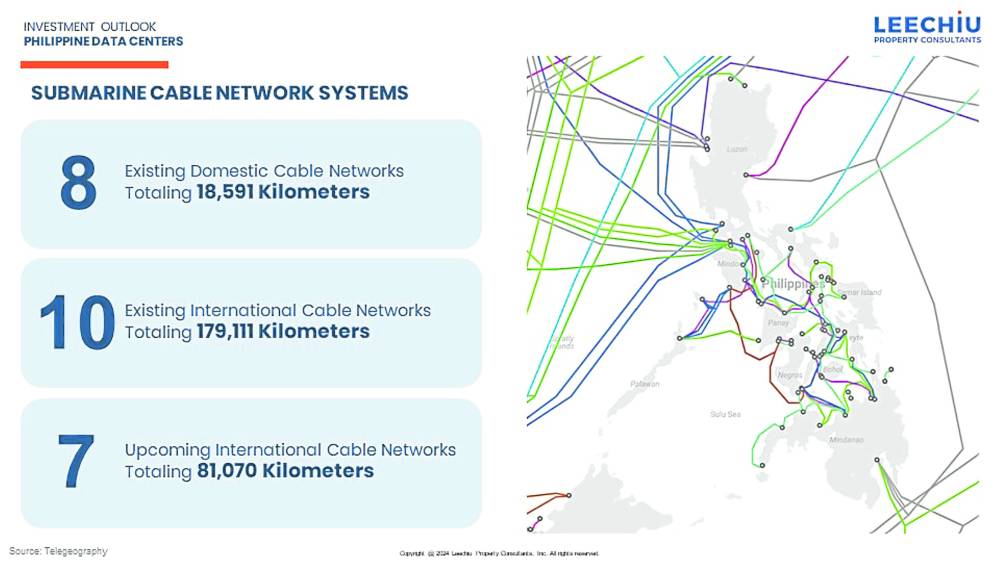

Supporting this demand is the Philippines’ robust IT infrastructure network, consisting of eight domestic submarine cable systems spanning 18,591 km and 10 international systems covering 179,111 km, with an additional 7 international systems spanning 81,070 km currently in development—totaling 278,772 km.

To put this in perspective, the Earth’s equatorial circumference is 40,075 km. These vital connections serve as the country’s gateways to the global digital marketplace, enabling high speed internet connectivity.

The Philippine government has also demonstrated strong support for the digital economy, evidenced by its implementation of a cloud-first policy for government processes.

Moreover, the Philippines’ strategic geopolitical position enhances its appeal as a data center hub in Asia. With strong ties with the United States and a key role in the Asia Pacific region, the Philippines is positioned to seize emerging opportunities in the digital economy.

Growth hurdles

Challenges, however, remain for the Philippines to become a major data center hub, such as real estate laws preventing foreign companies from buying land; expensive, unstable power supply; and frequent natural disasters like seismic activities and flooding.

However, these challenges can be addressed with thorough planning and the right strategies. Before development, data center operators may opt to secure pre-commitments from cloud technology giants like Amazon and Google. In terms of natural disasters, carefully selecting locations with the help of local experts and real estate consultants can mitigate risks.

Opportunities

The construction and operation of data centers can generate a wide range of job opportunities, directly and indirectly. These facilities require IT specialists, network engineers, and cybersecurity experts to maintain operations. As the industry grows, the demand for skilled professionals will continue to rise.

In real estate, data centers present a compelling opportunity for the industrial sector. Vacant properties are primed to command premium rents in this growing market. As data centers seek locations with reliable power, truck accessibility, and distance from fault lines, the industrial landscape is set for transformation, offering lucrative prospects for investors and developers alike.

The author is an assistant manager at the Research Department of Leechiu Property Consultants Inc.