2024 shaping up to be another banner year for Philippine banks

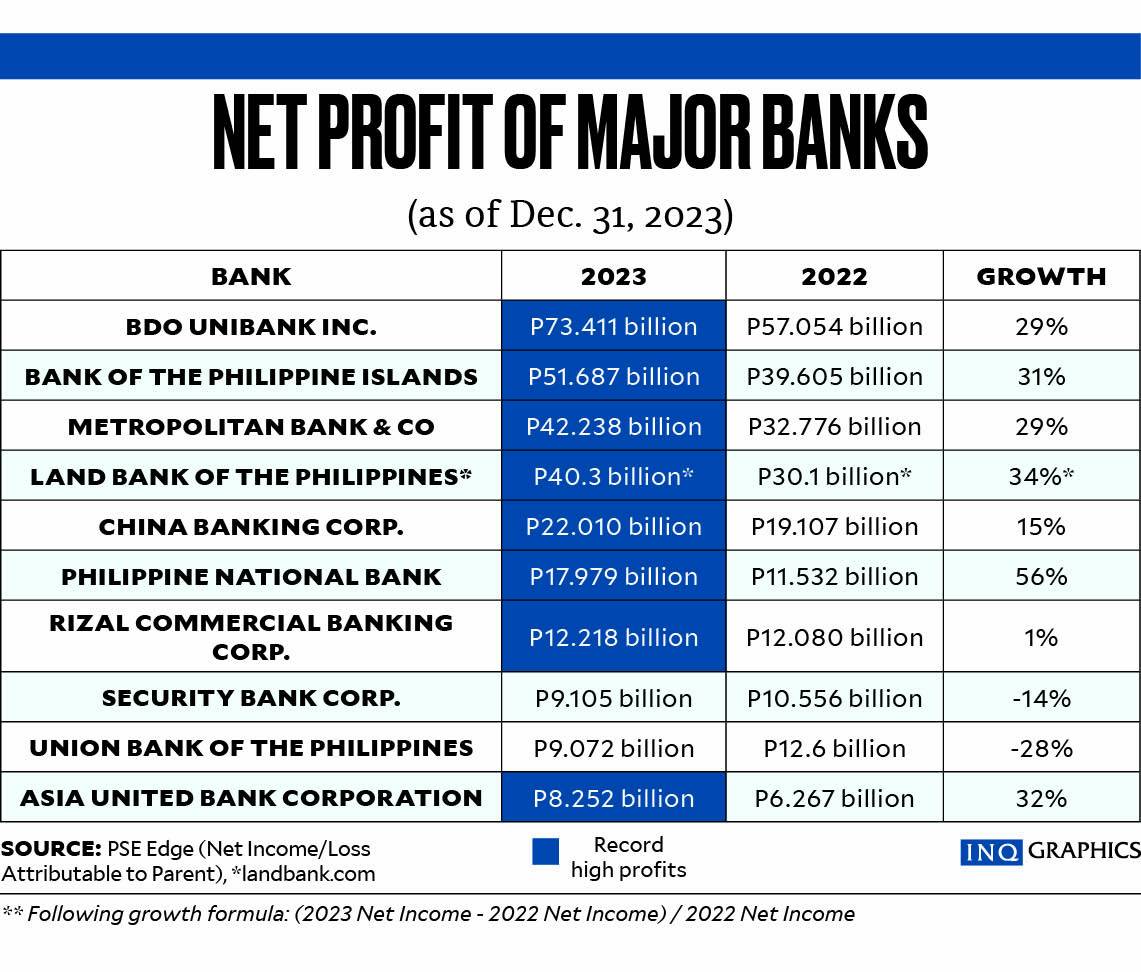

Despite the higher-inflation and slower-economic-growth backdrop in 2023, it turned out to be a very good year for Philippine banks, many of which even posted record-high profits.

The favorable momentum is expected to be sustained this year, especially as the macroeconomy, while still far from the “Goldilocks” state, has gone over the pandemic hump.

With consumer price pressures on the wane, the end of the hawkish cycle of the Bangko Sentral ng Pilipinas (BSP) is in sight, auguring well for the Philippine economy, which is expected to be among the fastest growing in the region.

Government economic managers expect the domestic economy to expand by 6 to 7 percent this year, faster than the 5.6-percent pace recorded last year. On the other hand, inflation is expected to stay within the BSP’s targeted range of 2 to 4 percent, easing from 6 percent last year when the country grappled with high commodity prices amid geopolitical tensions, trade restrictions from major rice-exporting countries and tight supply of key commodities.

Eight out of 10 of the country’s major banks posted all-time-high earnings in 2023.

“Philippine banking sector profitability hit a 10-year high in 2023, driven by wider margins. System asset quality has also held up well despite the sharp rise in interest rates, as indicated by the system nonperforming loan (NPL) ratio of 3.5 percent as of January 2024, helped by the supportive economic environment,” credit watchdog Fitch Ratings says in its April 5 review of Philippine banks.

Article continues after this advertisementThe agency says the financial performance of the local banking sector will likely remain “broadly steady over the next 12 to 18 months.”

Fitch Ratings believes that net interest margins for its rated Philippine banks have most likely peaked, and pressure on those margins will build in late 2024 when the BSP starts to ease the policy rate. But this will be offset by a pickup in loan growth and business volume amid a resilient economy, with Fitch Ratings projecting economic growth at 6 to 6.5 percent in the next two years.

“The conducive operating environment should also support the banks’ asset quality, and help sustain the privately owned banks’ risk appetite to expand into the higher yielding, albeit higher risk, consumer sector,” it says.

Bank lending increased by 7.8 percent in 2023, slower than the 11.5-percent expansion in 2022, as high interest rates deterred corporates from borrowing for large-ticket capital outlays, Fitch Ratings notes.

“Demand is likely to pick up, however, as uncertainty surrounding rate trajectory and economic growth dissipates. An acceleration in loan disbursement for certain public-private partnership infrastructure projects is also likely to spur loan growth,” it says.

April Lee-Tan, chief strategist at online stock brokerage COL Financial, says the outlook for the banking sector remains good this year.

“If [interest] rates go down, loan demand will increase,” Tan says.

“As for margins, the lower rates will also lead to lower funding costs, so maybe banks can preserve margins,” she says.

Another banner year for bank profits is possible as NPL ratios remain “healthy,” Tan says, adding that banks have a very high NPL coverage.

The stock of bad loans held by the Philippine banking system stood at 4.27 percent of total loans as of end-January. For commercial and universal banks, the NPL ratio was lower at 3.8 percent. The local banking sector has set aside reserves for more than 100 percent of its stock of bad loans.

All eyes on BSP rate cut

“When you look at the first quarter results and we think about what the next nine months will be, we’re fairly confident that it’s going to be a good, strong year,” says Jose Teodoro Limcaoco, president and CEO of Bank of the Philippine Islands (BPI).

“Obviously there are some risks that might be there. But we do see the BSP keeping rates higher for longer now, given the fact that inflation seems to be a little stubborn and growth in the United States seems to be very strong that the Fed (Federal Reserve) is in no hurry to cut [rates]. And there is really no impetus for our BSP to cut [rates],” Limcaoco says.

BPI is expecting its loan book to expand by 12 percent this year.

“What we see is that the consumer [segment] remains fairly resilient. There’s a lot of confidence. We’re continuing to see very strong growth along those segments and for us, I think that’s the reason why our income was quite healthy. We’ve been able to transform our book more toward the consumer side,” he says.

In the first quarter, BPI chalked up a record net income of P15.3 billion, up 25.8 percent from last year, and equivalent to a return on equity of 15.7 percent.

“I’m quite optimistic, I think we’re performing as a team very well. We are making inroads across all the initiatives we have,” Limcaoco says.

Nestor Tan, president and CEO of BDO Unibank Inc., believes that the BSP would move in lock-step with the Fed.

“From the outside looking in, there are two factors that you’ll have to manage — the interest rate and the impact of interest rate policies worldwide on our foreign exchange, both of which have inflationary and economic impact,” Tan says.

“If demand does go up, all we can do is just be ready; make sure that we have enough capital to support that and cover more markets, bigger markets, bigger geographical reach, so that when the demand does come, we have the inside track,” he adds.

BDO earned P18.5 billion in the first quarter, higher by 12 percent from the past year, as core businesses sustained robust performance. This resulted in an annualized return on equity of 14.3 percent.

Jerry Ngo, EastWest Bank CEO, says: ”Our bank benefits from a rate cut just because most of our loans are fixed, just because of the consumer side. We will be benefiting if and when a rate cut happens and the best way to do that is to take out risk by duration matching.”

Depending on the asset, EastWest offers a loan duration of around two to three years.

“We’re looking at mortgages but the repricing is between one to three years. We have a low mortgage. So far I think we’re able to handle it well. But we’re preparing,” he says.

Ngo adds that the bank is preparing adequate liquidity to hedge against market volatility.

“The team has been getting ready to essentially get term funding, as and when the markets go down. It has not happened yet, so that’s something we’re getting ready and getting prepared for,” he says.

“We have a program that we’re working on that allows us to pull multiple tenors: three, five and seven (years). Most probably, three (-year tenor) is the sweet spot at the moment. We are waiting and getting ourselves prepared,” the CEO says.

Risks ahead

COL’s Tan says that if pressures on interest rates and inflation intensifies, it will be challenging for banks.

“Trading income could be hurt by volatility of bond rates,” she says.

Foreign exchange volatility, she notes, could result in trading losses for banks.

“The challenges of the banking sector will be the economic outlook. There are risks from external factors,” BPI’s Limcaoco says.

He adds that everyone will continue to take cue from the BSP.

“I think everyone continues to watch what (BSP) Governor (Eli) Remolona says. He has been very transparent,” he says.

Meanwhile, Limcaoco, who is also president of the Bankers Association of the Philippines, wants to see the industry ramping up efforts to educate customers about financial scams.

“Talk about financial wellness, education. As the BSP and the industry try to bring people in for financial inclusivity, we just can’t bring them in; we have to teach them also how to be responsible depositors, how to use credit wisely, how to use savings wisely.”