Japan says it won’t rule out any steps to stem weak yen

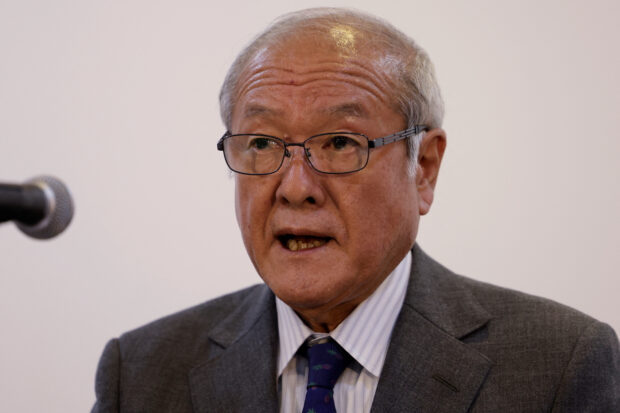

Japanese Finance Minister Shunichi Suzuki arrives for a news conference during the annual meeting of the International Monetary Fund and the World Bank, following last month’s deadly earthquake, in Marrakech, Morocco, Oct 13, 2023. REUTERS/Susana Vera/File photo

TOKYO — Japan Finance Minister Shunichi Suzuki said on Tuesday that he would not rule out any measures to rein in weakness in the yen, echoing a warning from the nation’s top currency diplomat the previous day.

Suzuki said a weak yen has both positive and negative effects on the economy but excessive volatility raises uncertainty for business operations. This in turn could hurt the economy, the minister said, reinforcing Tokyo’s focus on the velocity of market moves, rather than on specific currency levels.

“Rapid currency moves are undesirable,” Suzuki told reporters after a cabinet meeting. “It is important for currencies to move stably, reflecting economic fundamentals.”

READ: Yen steady after intervention warning, dollar dips

Early on Tuesday, the dollar was off slightly against the yen, fetching 151.26 and facing great resistance near the 152 level due to the threat of intervention from Japanese authorities. The greenback is up about 7 percent on the yen since the start of the year.

Article continues after this advertisementSuzuki declined to comment on the possibility of Tokyo intervening to stem the yen weakness, but suggested the speed of the currency’s fluctuations will be a factor in any decision to enter the market.

Article continues after this advertisementREAD: Japan warns against rapid, speculative yen falls

“If I answer the question about currency intervention, it could have unintended effects on the market,” Suzuki said, adding “if there’s excessive moves, we will respond appropriately without ruling out any measures.”

Japan last intervened in the currency market in September and October 2022 to stem the yen’s declines, initially when the dollar hit around 145 to the yen, and later in October when the U.S. currency surged to a 32-year high near 152 levels.