Property developers turn to freebies, discounts to entice buyers

Residential property capital values and rental rates have declined.

As the coronavirus pandemic slashed rental rates and jacked up vacancy rates across all real estate formats, property developers seek to entice consumers to buy yet-to-be-built residential condominium units with various freebies and sweeteners.

Richard Raymundo, managing director at property consulting firm Colliers International Philippines, said at a press briefing on Thursday that residential property developers had been able to sell part of their inventory even during the lockdown period by being “creative.”

“They really went gung-ho on social media,” Raymundo said, citing steep discounts, lower and longer payment terms, waiver of reservation fees to even offering free appliances.

“All of those helped. For people who had genuinely had the intention of buying, they were persuaded,” he said.

For the residential condominium units that are up for rental, Colliers reported that vacancy rates in Metro Manila have risen for the fifth straight quarter and likely to worsen in the second half of 2020. Overall vacancy rate is now at 11.8 percent from 11.3 percent a quarter ago, with some 665 units vacated in the second quarter.

Article continues after this advertisement“The condominium market is starting to feel the adverse impact of the pandemic and lockdown,” said Colliers senior manager Joey Roi Bondoc, citing a drop in condominium completions and weaker appetite for units.

Article continues after this advertisementWith the rising number of unsold units in the capital, Colliers expects developers to be more aggressive in offering bigger discounts—10 percent to 15 percent of the total contract price—and to offer more flexible payment terms for preselling projects.

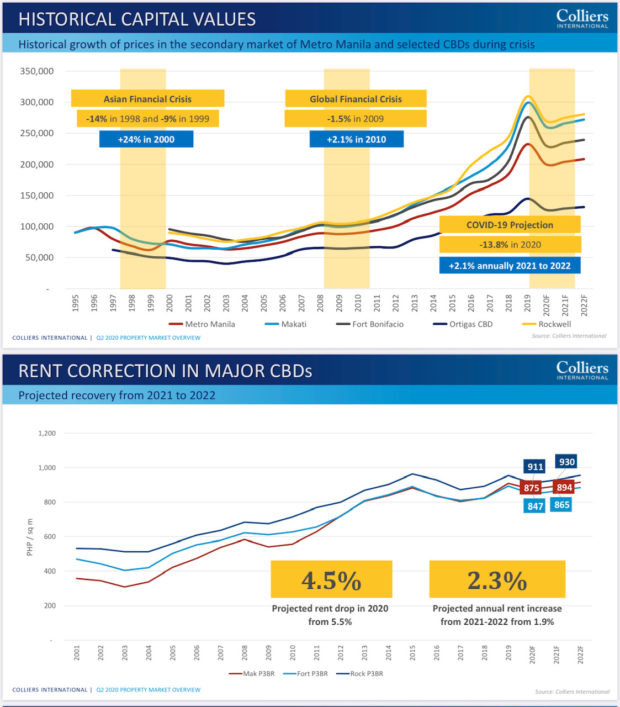

With such increase in unsold inventory, Colliers is projecting average prices to soften by 13.8 percent in 2020. But Colliers projected that the economic recovery in 2021, complemented by a revival of traditional and outsourcing business activities in Metro Manila, should help prop up leasing, thereby resulting in a 2.3-percent increase in lease rates starting next year.

For 2020, Colliers projects average office lease rates in Metro Manila to drop by 17 percent due to subdued leasing and early lease terminations while office vacancy rate is seen to rise by 1 percentage point to 5.3 percent.

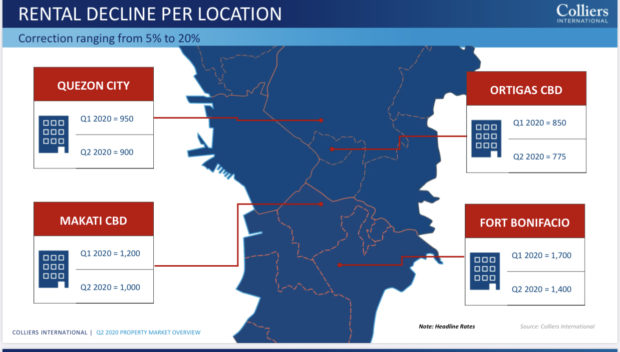

office rental rates in key cities in Metro Manila

In the second quarter alone, Colliers estimated a 4.9 percent office vacancy in the metropolis, the highest vacancy recorded since the third quarter of 2019 due to reduced space demand from Philippine offshore gaming firms (POGOs), outsourcing and traditional firms. If all POGOs exit the market, vacancy rate in the metropolis is expected to rise to 16 percent.

Colliers sees further correction in submarkets where there is large upcoming supply and where new space mainly targets POGO firms. Such vacant space is seen to be offered to non-POGO tenants at a 20-30 percent discount.

Asked how accommodating office property landlords have been during this pandemic, Colliers director Dom Fredrick Andaya said: “Everybody is willing to help but without compromising their own companies. The small developers are more generous in terms of giving concessions. I believe it’s also because they need the tenant more than the big developers, because the big developers are more diverse and they have better branding.”

But one hiccup cited by Andaya is that the creditor-banks of property developers haven’t been accommodating. “I don’t think the banks will relent because we need the banks to be the most stable right now,” he said.

Over the next 12 months, Colliers sees companies that provide essential services leading office absorption while some outsourcing firms might opt for plug-and-play offices for their immediate space requirements.

Another trend seen by Colliers for the remainder of 2020 is greater office take-up in fringe, non-core locations such as Quezon City, by traditional occupants. This is as major outsourcing occupiers are seen to expand into non-core locations to minimize costs, given uncertainties in the market.

Colliers expects office leasing rate to rebound by 2 percent starting 2021.