Sun Life sees PSEi rebounding to 6,800 in 2020

Sun Life’s stock market outlook

Even with the coronavirus pandemic-induced lockdown protocols likely to hurt corporate earnings more in the second quarter, insurance giant Sun Life of Canada sees room for the main stock barometer to recover to 6,800 this year.

In a market briefing last week, Sun Life of Canada (Philippines) Inc. chief investments officer Michael Gerard Enriquez said that with bond yields hitting new lows across the curve due to the central bank’s monetary easing, local equities had become “undervalued” compared to bonds with an implied equity yield of 7.03 percent versus a net bond yield of 2.64 percent.

“Clearly, there is a lot of upside potential on this valuation but it is up to how our economy can bounce back faster than what investors are forecasting,” Enriquez said.

But Enriquez said 6,800 could be a “realistic” target for the Philippine Stock Exchange index (PSEi) even assuming that full-year corporate earnings would contract by 10 percent this year and that investors would be willing to pay only 13.7 times the kind of money they expect to make from this basket of stocks. In the last 15 years, investors have been willing to pay for local equities at 15.2 times potential earnings.

For the second quarter alone, he said corporate earnings could fall by over 25 percent, given a grim preview seen in the first quarter.

Article continues after this advertisementSun Life’s 6,800 PSEi outlook was based on a fair market value derived from a bottom-up approach, whereby the earnings contraction and target price were computed by looking at each of the 30 companies comprising the main basket.

Article continues after this advertisementEnriquez sees the PSEi’s next resistance closer to the psychological barrier at 6,000 and then at 6,268, while support is seen resting closer to 5,300 and then at 4,623.

On Friday, the PSEi racked up 268.62 points or 4.82 percent to close at 5,838.84, outperforming regional markets as foreign funds flowed into the market. This was as investors anticipated the reopening of Metro Manila after a two-month lockdown alongside a scramble to align with the latest rebalancing of the closely tracked MSCI indices.

Some of the consumer companies like fast-food giant Jollibee Foods Corp. and some of the conglomerates, especially those with shopping mall operations, as well as property counters, would likely drag down the PSEi the most, Enriquez said.

“The more resilient ones were outside the radar previously. Telcos are suddenly now most favored in the market,” he said.

Social distancing and work-from-home protocols, which in turn boost demand for connectivity, are seen to bode well for the earnings of PLDT and Globe Telecom.

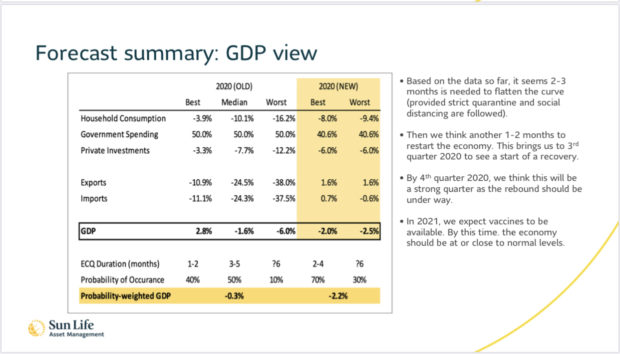

For the second quarter, Sun Life sees the Philippine gross domestic product (GDP) contracting by 5-6 percent. For the full year, it expects the contraction to be tempered to 2.2 percent as recovery may start by the third quarter.

Sun Life PH’s macro outlook

“By fourth quarter 2020, we think this will be a strong quarter as the rebound should be under way. In 2021, we expect vaccines to be available. By this time, the economy should be at or close to normal levels,” he said.

“We think the recovery will likely look like a U-shaped (recovery): one with GDP to initially be weak then slowly ramp up. But markets will be volatile on the recovery phase,” he added.

With the National Capital Region reopening for business soon, a slow and steady recovery may be coming soon.

“However, coming from what we’ve seen from other countries- Wuhan (China), South Korea, Japan – even if the economy is open, the behaviour has changed among the consumers. We don’t see people flocking to malls, going to restaurants after the opening. For this reason we expect there should be more time for people to adjust to the new norm. There is still a lot of uncertainty on how different companies will react,” Enriquez said.

Apart from the upcoming lifting of the modified enhanced community quarantine and the low valuations, Enriquez said a decline in daily COVID-19 infection could be a near-term positive driver for the market.

On the other hand, he said further earnings downgrades, the outflow of foreign funds and a potential spike in new COVID-19 cases would be the negative drivers.—DORIS DUMLAO-ABADILLA INQ