Vending machine biz in Japan gets makeover

Soft drink companies develop vending machines with special features to meet consumers’ demands. (The Japan News/ANN/File photo)

TOKYO — Soft drink companies are increasingly developing their vending machine businesses, introducing special features that can meet diverse needs among consumers, while also aiming to improve the efficiency of vending machine operations.

The success of their efforts to boost the business will depend on whether they can win back consumers, who tend to buy soft drinks at convenience stores that sell beverages at lower prices, observers said.

“It’s delicious. I’ve never tasted anything like this,” said a 15-year-old high school student after trying a chilled Mitsuya Cider drink.

Asahi Soft Drinks Co. has developed a new vending machine that can cool beverages to below freezing so that consumers can enjoy slushed-ice-like drinks. The firm introduced the new machines in late April and plans to install about 280 units nationwide by the end of this month.

Many soft drink companies are trying to implement measures to better cater to consumers’ needs.

Article continues after this advertisementFor example, while a 500-milliliter bottle is the standard size for PET bottles sold in vending machines, Coca-Cola Bottlers Japan Inc. offers smaller sizes for fruit juices and other beverages that are popular particularly among female customers. The company also places a small mirror on the front of some machines so that customers can check their appearance, while other machines offer customers straws.

Article continues after this advertisementSome companies are setting up more indoor vending machines. DyDo Drinco Inc., for example, plans to shift its focus to providing vending machine services at offices, factories and other indoor locations that provide steady sales.

By targeting corporate clients, DyDo Drinco plans to increase the ratio of its indoor vending machines to 50 percent from the current 40 percent to boost sales. The company has expanded soft drink lineups since March, by offering Asahi Soft Drinks’ beverages in DyDo Drinco machines.

30% drop from peak

Soft drink makers have been reviewing their vending machine strategies, as they are losing ground to convenience stores, which sell beverages at lower prices.

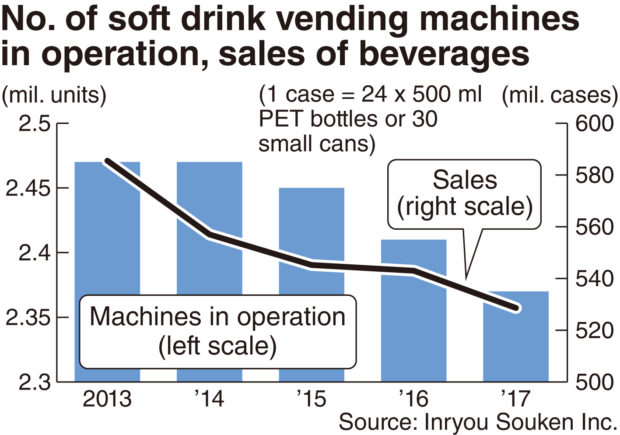

According to Inryou Souken Inc., a firm that collects industry data, the number of soft drink products bought from vending machines in 2017 totaled about 528.6 million cases ― one case contains 24 500-milliliter bottles or 30 small cans. While the soft drink market has been growing, the figure has declined by 30 percent since its peak 20 years ago. The ratio of sales from vending machines has dropped from about 50 percent to about 30 percent over the period.

Nevertheless, soft drink companies still focus on the vending machine business, as many products are sold at fixed prices. For some manufacturers, more than half of their profits are generated from sales through vending machines.

Promoting efficiency is also an indispensable factor in mapping out a strategy to survive the vending machine business.

A large workforce is needed to check and refill vending machines on a regular basis to ensure they do not run out of stock. To address this issue, soft drink companies are accelerating efforts to make internet-connected vending machines so they can check remotely if products are out of stock.

Asahi Soft Drinks President Katsuhiko Kishigami said the firm will consider working with other companies. “Collaboration is a possible option to resolve the challenges,” he said.

Inryou Souken director Kazuhiro Miyashita said it will not be easy to make a breakthrough unless soft drink companies take radical measures. “There could be some moves for further realignment of the industry, with the vending machine business at its core,” Miyashita said.