Southeast Asia: Cool, Cashless, Connected

What does Southeast Asia’s stride into the digital age mean for its tourism? For starters, the region is shedding its image as a backpacker heaven to a more travel-convenient destination.

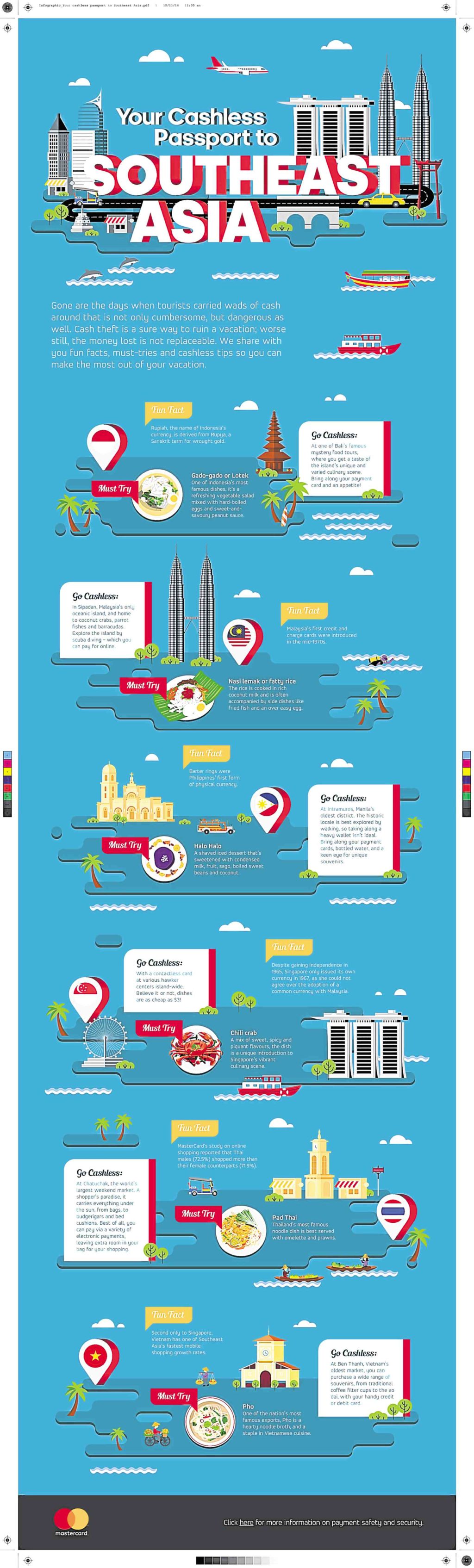

Incoming tourists no longer need to make visits to a money-changer or bring along a heavy cash-stuffed wallet just to pay for a single souvenir.

Instead, many are increasingly becoming sleek and sophisticated, travelling with no more than just their credit, debit or prepaid card and passport in tow.

As the region modernizes, so have the ways to pay.

Governments are working to find new methods to embed digital payments into their cities’ core infrastructures, as they work to create more intuitive, welcome spaces for residents and visitors alike.

Article continues after this advertisementTake Singapore’s beloved hawker centers as an example.

Article continues after this advertisementMany food courts now accept a variety of contactless payments. Consumers looking to try a plate of chicken rice or chili crab can do so without the hassle of handling cash.

Moreover, a growing understanding of the safety and convenience of electronic payments have convinced more consumers to upgrade from paper to plastic.

According to the Mastercard Safety and Security Index, the majority of consumers in the region are more likely to shop online if they know about the site’s payment verification services.

It’s an exciting time to visit Southeast Asia. With its diverse cuisines, multifarious shopping options, and world-class business and transportation facilities, the region is fast gaining recognition as a key global destination.

As consumers receive greater access to digital payment options, it won’t be long before they’ll be booking, paying, and zipping from one destination to another, with the simple tap of a button.