Inflow of foreign funds brings up stock index to 7,800

The local stock barometer firmed up at the 7,800 level on Thursday on a wave of foreign fund inflows into the stock market.

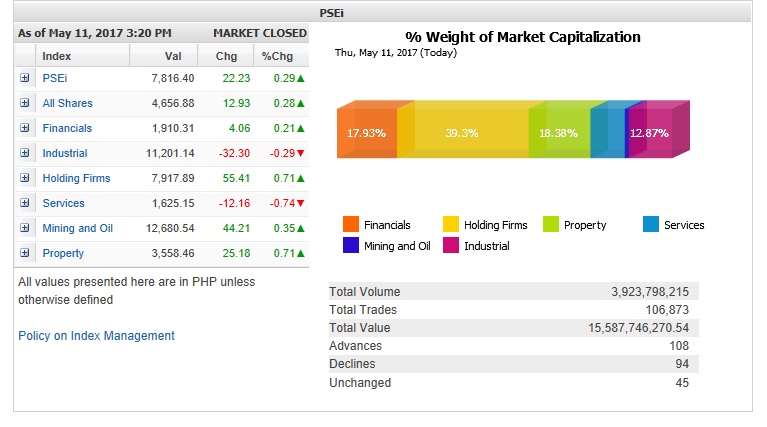

Tracking mostly upbeat regional markets, the Philippine Stock Exchange index added 22.23 points or 0.29 percent to close at 7,816.40.

The day’s gains were driven by the financial, holding firm, mining/oil and property counters while the industrial and services counters slipped. Investors have priced in the earnings performance of many large-cap stocks and other closely-followed stocks.

Value turnover was heavy at P15.59 billion. There was a P4.56-billion special block sale on shares of BPI consisting of 45.63 million shares at P100 a share. There were 108 advancers that edged out 94 decliners while 45 stocks were unchanged.

The PSEi has seen a wave of foreign buying in the last few days, even on Wednesday when concerns over some company’s first quarter earnings resulted in a sharp pullback. On Thursday, the net foreign inflow into the stock market was pegged at P1.28 billion.

Shares of Petron Corp., which earlier reported a doubling in net profit, surged by 4.96 percent on Thursday.

Article continues after this advertisementInvestors also gobbled up shares of Ayala Land, which rose by 2.07 percent and was the most actively traded company for the day. Ayala Land’s first quarter profit was better than what the market expected.

Article continues after this advertisementGT Capital, SM Investments, BDO and AEV all firmed up by over 1 percent while SM Prime, ICTSI, Ayala Corp., Semirara and BPI also contributed gains.

Outside of the PSEi, City of Dreams Manila operator Melco Crown was among the notable gainers, rising by 2.44 percent on earnings play.

On the other hand, Robinsons Land fell by 4.39 percent after reporting an 11-percent drop in first quarter net profit.

Investors also dumped shares of URC, which declined by 3.74 percent, after reporting a 4.2 percent drop in first quarter income.

PLDT also fell by 2.44 percent ahead of its corporate earnings report while JG Summit, AGI, Globe and Megaworld also slipped.