Stocks close higher as fears of further US rate hikes ease

The local stock barometer firmed up Thursday on rising bets that US interest rates won’t rise further too soon.

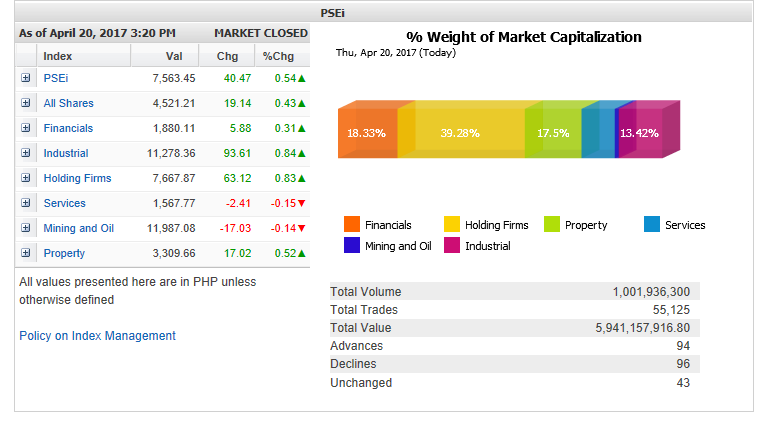

The main-share Philippine Stock Exchange index added 40.47 points or 0.54 percent to close at 7,563.45, tracking mostly firmer regional markets.

“[The] Philippine market closed higher as the probability of a June rate hike is now below 50 percent and with new information on the latest release of the Beige Book,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

The “Beige Book” is the US Federal Reserve’s commentary on current economic conditions. This document assessed that the US economy had expanded at a modest-to-moderate pace between mid-February and the end of March while keeping inflationary pressures in check despite more difficulties in attracting and retaining workers.

At the local market, the day’s gains were led by the financial, industrial, holding firm and property counters.

Article continues after this advertisementOn the other hand, the services counter and mining/oil counters slipped.

Article continues after this advertisementValue turnover for the day amounted to P5.94 billion.

Despite the PSEi’s rise, there were slightly more decliners (96) than advancers (94) in the market.

Investors picked up shares of RLC, DMCI, URC and JG Summit, which all surged by over 3 percent while Metrobank added 2.08 percent.

Megaworld, SM Investments and AGI all gained by over 1 percent.

ICTSI, ALI, AC and Jollibee also firmed up.

Outside the PSEi, one notable gainer was gaming firm Bloomberry, which rose by 4.98 percent.

Meanwhile, GT Capital continued to slip, down by 2.57 percent. The conglomerate earlier announced an increase in its interest in Metrobank.

PLDT fell by 1.18 percent while Security Bank, Puregold and Metro Pacific also declined.