PSEi tumbles on local telco woes, Wall Street weakness

The local stock barometer tumbled yesterday as weak sentiment in Wall Street spilled over to regional markets while legal jitters dragged telecom stocks.

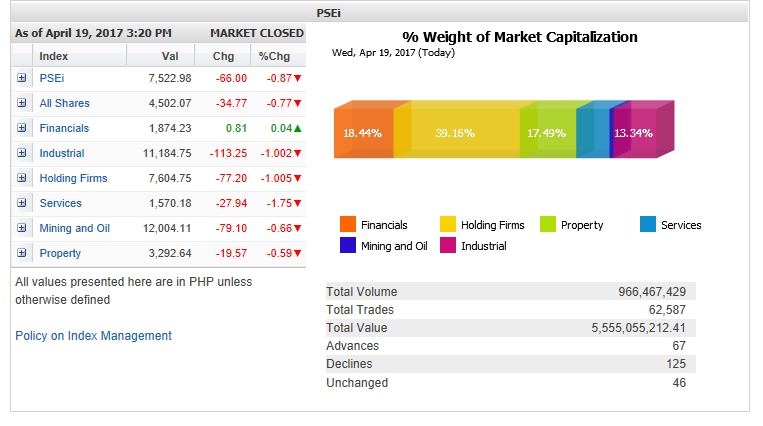

The main-share Philippine Stock Exchange index (PSEi) lost 66 points or 0.87 percent to close at 7,522.98.

PLDT led the PSEi lower with its 3.41-percent drop while JG Summit—a key investor in PLDT—also tumbled by 3.05 percent. Globe likewise fell by 2.45 percent.

This was after the Philippine Competition Commission (PCC) elevated to the Supreme Court a petition to allow it to review the P70-billion sale by San Miguel Corp.’s telecom assets to PLDT and Globe. The Court of Appeals, acting on a petition from PLDT, had earlier blocked the PCC’s attempt to review the controversial transaction.

PCC, the Philippines’ antitrust body, had said that the transaction allowed PLDT and Globe to corner a disproportionate share of much-coveted telco frequencies.

Article continues after this advertisementAs telco stocks slipped, the services counter also fell by 1.75 percent while the industrial and holding firm counters also slipped by more than 1 percent.

Article continues after this advertisementThe mining/oil and property counters also declined. The financial counter, on the other hand, ended slightly higher.

“Philippine markets were sold down heavily mostly in reaction to US equities falling on Tuesday after Goldman Sachs shocked Wall Street by missing estimates,” said Luis Gerado Limlingan, managing director at local stockbrokerage Regina Capital Development.

“Investors also remained vigilant amid US-North Korea tensions and the nearing of the French presidential election. British Prime Minister Theresa May announced that she is calling a snap general election in the UK, with the vote to be held on June 8, and so the FTSE100 fell sharply,” he added.

In the local market, value turnover for the day amounted to P5.55 billion. Market breadth was negative as there were nearly twice as many decliners (125) as advancers (67).

Outside of telecom stocks, investors also sold down other large-cap stocks like SM Investments, GT Capital, Jollibee and URC, which all declined by more than 1 percent.

BPI, Ayala Land, SM Prime, Ayala Corp., Semirara, ICTSI and AGI also contributed to the day’s decline.

On the other hand, BDO, DMCI, MPI and Megaworld eked out modest gains.