PSEi tumbles on US interest rate jitters

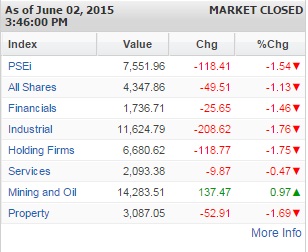

The Philippine Stock Exchange index tumbled by 118.41 points or 1.54 percent to close at 7.551.96, tracking mostly weaker peers in the region.

A string of US data which showed an increase in manufacturing output and construction spending escalated the guessing game on how soon US interest rate hikes will come.

At the local market, the day’s decline was led by the financial, industrial, holding firm and property counters which all slumped by over 1 percent. The mining/oil counter eked out a modest gain.

Value turnover was thin at P4.58 billion. There were 61 advancers which were overwhelmed by 95 decliners while 41 stocks were unchanged.

Investors locked up gains from URC which fell by 3.62 percent while GTCAP, BDO, JG Summit, AGI, BPI and EDC also fell by over 2 percent.

Article continues after this advertisementThe day’s most actively traded stock company was ALI, which fell by 1.99 percent while SMIC and SM Prime also declined by over 1 percent.

Article continues after this advertisementPLDT, Metrobank, Jollibee and Globe also contributed to the day’s decline. Outside of the PSEi, RRHI (-0.66 percent) and VLL (-1.38 percent) fell in heavy trade.

Among those that bucked the downturn in relatively heavy volume were FNI (+8.39 percent) and Nickel Asia (+5.42 percent) while RFM was likewise up (+0.46 percent).

FNI earlier announced the purchase of more shares leading to a controlling stake in nickel mining firm Platinum Group Metals Corp.

Local stock brokerage DA Market Securities said with the PSEi now back above the 200-day moving average critical support, the index was “now testing a base of support nearby the 7500 level / recent low.”

While technical indicators suggested that the market was oversold and showing a slight uptick, DA Market said the PSEi remained in a bearish crossover.

“Short-term positions would be a challenge and if attempted, would require tighter trading stops in possible bounces. Long-term investors are recommended to buy on dip/employ pyramid buy strategy,” the brokerage said. “Selective stock picking remains to be key.”

The brokerage said the important support levels to watch for a possible base/bottom would be 7,385, 7,210 and 6,950.

Seasonal catalysts that can curb trading volume and induce profit-taking are: lack of leads post-first quarter earnings season, the beginning of summer in the West and locally, the re-opening of local schools, DA Market said.