Filipinos seen ‘overtaxed’ by up to P1.8T

MANILA, Philippines—A legislator on Tuesday said Filipino taxpayers could have been “overtaxed” by up to P1.8 trillion under a taxation system that remained unadjusted since 1997, while the Department of Finance (DOF) readies proposals to plug leaks that may be caused by income tax reforms.

During Tuesday’s technical working group meeting of the House committee on ways and means, Bayan Muna Rep. Neri J. Colmenares claimed that P1.2 trillion to P1.8 trillion in excess taxes had been possibly collected from income earners.

Colmenares later told the Inquirer that the figure was based on his group’s initial calculations of the income brackets being slapped taxes even as these remained unadjusted to inflation since 1997.

The militant lawmaker earlier filed House Bill (HB) No. 5401, which is aimed at restructuring income brackets and their respective tax rates. Colmenares proposes slapping income tax on earnings beyond an annual “living wage” of more than P300,000.

He also pegged the “living wage” at P1,086 per day, an income level that “will assure decent living.”

“It’s time for the government to return (the money) to the people. A lot of these taxpayers’ money didn’t go back to taxpayers at all,” Colmenares said.

At least 14 measures are pending in the Lower House, all proposing amendments to the National Internal Revenue Code of 1997 in a bid to lower income tax rates. The House ways and means committee is currently working on a substitute bill to consolidate the pending bills.

At present, yearly taxable income of as low as P10,000 is already slapped a 5-percent tax, which goes up to a high of 32 percent for those earning P500,000 and above. These are among the highest income tax rates in Asean.

Finance Undersecretary Jeremias N. Paul Jr. told the meeting that the DOF’s computation showed P30 billion in foregone revenue yearly once the taxable income brackets are indexed to inflation.

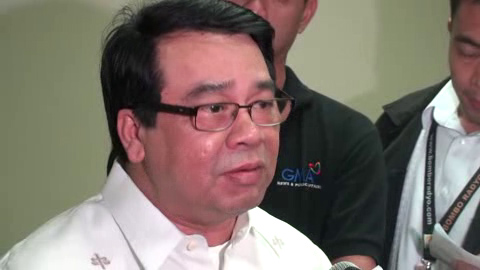

In an interview, Paul said the DOF figure was based on HB 4829 filed by Marikina City Rep. Romero “Miro” S. Quimbo, which sought the adjustment of the top tax base to P1.4 million from P500,000 based on the consumer price index.

The bill, which also called for the indexation of other tax brackets to inflation, sought the exemption from income tax payment of those earning P180,000 and below a year.

RELATED STORIES

House panel eyes lower income tax rate