Establish more local sources of growth, emerging marts urged

MANILA, Philippines—Emerging markets like the Philippines will have to further strengthen their domestic sources of growth to ensure that their economies are able to face the headwinds caused by crises in the developed world.

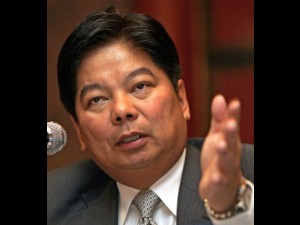

Bangko Sentral ng Pilipinas (BSP) Governor Amando M. Tetangco Jr. said the economic prospects of developing nations will stay at the mercy of external developments unless policymakers are able to improve local fundamentals.

“For emerging markets, the main challenge is to broaden and deepen domestic sources of growth. Across the globe, policy makers need to be mindful that growth policies do not undermine financial stability,” Tetangco said.

Delivering a speech during the International Monetary Fund’s (IMF) autumn meetings in Washington, Tetangco highlighted the Philippines’ success in insulating itself from external shocks.

He said the overall resilience of the Philippine economy could be attributed to the country’s solid macroeconomic fundamentals, including a low and stable inflation environment, strong external position, sound and stable banking system, and healthy fiscal position.

Article continues after this advertisement“In addition, we put in place buffers to cushion the effects of increased uncertainty due to financial market volatility,” he said.

Article continues after this advertisementAs a result, the Philippines posted a robust growth of 7.6 percent in the first half of 2013, one of the fastest in the region.

He noted that this was achieved at a time of weak conditions abroad.

Despite the country’s strengths, Tetangco said local policymakers were still wary of developments in the advanced economies and the impact these have on the Philippines’ domestic growth and inflation paths.

He urged the IMF to take a more active role in helping emerging markets ride out the effects of various financial crises caused by factors beyond their control.

“The IMF is well-situated to take the lead in global surveillance—by monitoring and analyzing not only the likely impact of the policies of the advanced economies on the rest of the world, but also how such effects on the rest of the world would feed back to the advanced economies,” Tetangco said.

Also key to the IMF’s effectiveness in putting out fires are reforms that will give emerging markets a louder voice in the Fund’s policymaking bodies.

“For us in the emerging markets, this means, among others, the implementation of the IMF quota and governance reforms,” Tetangco said.

“The Annual Meeting is a time to assess the progress toward our goal of enhancing the Fund’s credibility, legitimacy and effectiveness,” he added.