Nissan’s rammin’ move

IT’S NOT that easy to maintain an assembly plant in the Philippines. When auto manufacturers compare shops among Asian nations, they will find that doing business in the Philippines a bit “shocking,” what with the higher cost of electricity here which results to higher operating costs. The result has been that the local auto industry imports more completely built-up (CBU) units, and the few remaining assembly plants have been reduced further with the recent spate of closures. It is, therefore, refreshing to learn of an auto manufacturer going against conventional wisdom—not just sticking to its assembly lines here but even adding to the assembly lineup.

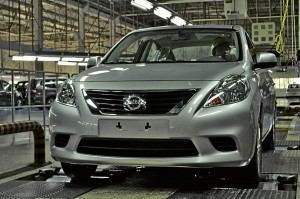

Nissan Technopark (of Nissan Motor Philippines Inc. in Sta. Rosa, Laguna), which has been operating since 1997 with an overall assembly capacity of 3,000 units per month (one of the largest in the industry), has been putting together the all-new 1.5-liter Nissan Almera compact sedan, touted to be a fierce rival of Toyota Vios, Honda City and Hyundai Accent. The Almera 1.5L, which started being assembled here this September, will be officially introduced locally in January 2013.

The Nissan Technopark, at 236,439 square meters, is one of the country’s biggest manufacturing hubs. The facility produces Nissan vehicles, including the X-Trail, Grand Livina and Sentra 1.6L. The plant houses a fully automated conveyor system, a computerized production track system and automatic liquid dispenser system. The 11-dip electro deposition coating system (resulting in zero-rust body treatment) is a highlight in the Almera production process.

A TECHNICIAN checks on one of the Almera units being readied at the Nissan plant for the January launch.

Not inclined to disclose actual production numbers, Nissan, however, did reveal that all Almera units being assembled are for local customers. Thailand, India, Malaysia, China, Vietnam and the United States would have their own locally assembled Almeras, as well as other Nissan vehicles. The biggest producer of Almera would be China.

The name Almera was created from “Almendra,” meaning “a large diamond” in Spanish. Nissan expressed that it wants the Almera to exude the combination of youth and—drum roll please—the Mediterranean ambience, thus, it would be packaged as affordable yet upscale as far as the design, comfort and roominess go. When it was launched in 1995, the initial Almera was packaged as a small family car.

Not all CKDs

Not all Nissan cars roaming the country’s streets are assembled here, however. The Teana and Sentra 200 are imported as CBUs from Japan and Mexico, respectively.

In a statement, NMPI says that sustaining more locally assembled vehicles than importing CBUs in the Philippines has definitely been a challenge, as higher manufacturing costs need to be hurdled.

NMPI SAYS that with more meaningful incentives, the Philippines’ vehicle production hubs can thrive.

“Most assembly plants in the Philippines are under-utilized, since we have to contend with high overhead costs that limit our flexibilities and ability to compete with our Asean counterparts,” NMPI president and CEO Allen Chen said. “This problem is further compounded by the high cost of electric power, the highest, in fact, in the Asean region.”

NMPI says that the Philippine car manufacturers and assemblers also have to contend with imported CBU vehicles, which have become more attractive over the years due to free trade agreements with other regions.

“Despite the continuous difficulties encountered by the local automotive industry, NMPI remains steadfast in its commitment to maintain our plant facility,” Chen said. “We choose to be resilient, as we are optimistic that our industry will soon become more competitive with other Asean markets, especially with the government’s support.”

Maximive changing trends

NMPI says that with more meaningful incentives, the Philippines’ vehicle production hubs can thrive. The company aims to maximize the changing trend in Nissan’s global vehicle planning and development, such as what has happened with the Almera.

Chen explains that, with Nissan, the usual strategy had been to do vehicle planning and development in major countries first, and then introduce the vehicle into emerging markets. Since the Philippines belongs to the emerging markets category, there are some unique market segments that Nissan still needs to represent well. “However, with the new Nissan Almera, Nissan focused firmly on the emerging countries first, and created vehicles that meet the needs of these markets. Nissan was able to develop a vehicle that is practical and affordable yet equipped with enough features to satisfy the discriminating taste of customers.”

Starting the production of the Almera was not easy. Like what it did to its other CKDs, NMPI had to utilize a series of stringent processes, usually lasting for 18 months, before it could begin assembly at the NMPI plant. An evaluation system was carried out by the global head office Nissan Motor Co. Ltd., before the engineering trial in order to determine the preparedness of the manufacturing division. After that, a production trial was conducted wherein one lot of each model variant was produced to verify the accuracy of technical documents. This step also ensured that the quality assurance system, product quality and important parts related to safety were in place. Similar evaluation processed would again be carried out during the initial production before the final delivery to the customer.

According to NMPI, customers have been reserving Almera units and getting exclusive accessory packages for free, which includes chrome side molding, exhaust finishers and chrome front lower grille finishers.

NMPI’s Laguna facilities also boast an integrated wastewater treatment facility.

NMPI says its manpower skills are at par with its other overseas plants, as the NMPI workforce continuously receives training at its training and research center (TRC) also located at the Nissan Technopark.