SEC draft rules may hurt Philippine industries, says MVP

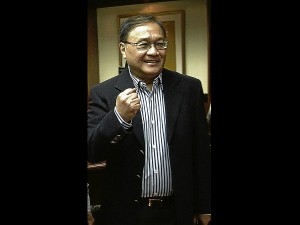

MANILA, Philippines—Businessman Manuel V. Pangilinan has urged the Aquino administration to prioritize policies, including possible amendments to the Constitution, to welcome foreign investments in restricted industries such as telecommunications and mining.

Pangilinan’s concern stems from the decision of the Securities and Exchange Commission (SEC) to draft rules on foreign ownership that may further restrict the participation, even through passive investments, of foreign entities in key Philippine industries.

The SEC is acting on orders from the Supreme Court.

“What this country needs to come to grips with is if it needs foreign investments to develop certain industries,” Pangilinan said Tuesday at a press conference.

The SEC this week started public consultations regarding foreign entities and the extent of their shareholdings in Philippine companies engaging in telecommunications, transportation, mining and media.

Article continues after this advertisementThis came about after the high court upheld a ruling where Philippine Long Distance Telephone Co. (PLDT) was found to have violated constitutional restrictions by allowing foreign firms to own over 40 percent of the telco’s voting shares.

Article continues after this advertisementThe Constitution limits the ownership by foreigners in public utilities to 40 percent.

The telco, chaired by Pangilinan, has since revamped its capital structure through the issuance of voting preferred shares. This allows profit to flow to foreign groups that have invested the most money in PLDT, while keeping voting rights in the hands of local entities.

PLDT is controlled by First Pacific Co. Ltd., a holding company based in Hong Kong. First Pacific was founded by Pangilinan and DTT DoCoMo of Japan.

Under its draft rules published this week, the SEC said it might also prohibit the practice of issuing shares that have voting rights but pay less in terms of dividends compared to normal shares. Shares structured this way are usually issued to foreign investors.

The SEC’s draft rules state that a share’s “political interests” must be equal to its “economic interests.”

But Pangilinan said PLDT and several other major companies in industries covered by the rule would be affected. He warned that many, if not all foreign investors in the country, would leave the country in favor of other Southeast Asian markets that, unlike the Philippines, are starting to open up to more foreign capital.