Conglomerate San Miguel Corp. is expected to post double-digit growth across all its businesses, particularly the food segment, in the first half of the year.

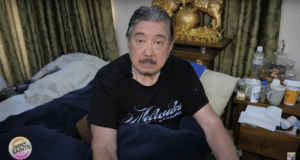

At the sidelines of the Petron Fellowship Night on Tuesday, San Miguel president Ramon S. Ang told reporters that Petron Corp., the country’s biggest oil refiner and retailer, was also seen posting double-digit profit growth during the period.

Ang declined to divulge further details. In the first semester last year, San Miguel booked P6.28 billion in consolidated net income, down by 89 percent from the previous year. However, the company said the decline was only because of the extraordinary gains made from the sale of a substantial stake in the beer brewery business in the first half of 2009.

Petron, however, posted a 64-percent increase in its consolidated net income to P2.96 billion in the first half of 2010, fueled largely by higher domestic sales during the period.

In the meantime, Ang said San Miguel had been working on international acquisition deals for coal and liquefied natural gas.

“We’re targeting to have an investment in Indonesia for coal and Australia for natural gas. When it comes to energy-related (investments abroad), Indonesia and Australia would be the best bets,” Ang said.

Ang said San Miguel was eyeing several potential coal sites in Indonesia and natural gas fields with huge proven reserves in another country.

San Miguel’s intensified interest in the coal and natural gas sectors is in line with its plan to build a power generation portfolio, consisting mostly of facilities fueled by coal and liquefied natural gas.

In a related development, Ang confirmed that Petron would push through with the planned share sale (public offering) within this year to comply with the listing requirement of the Philippine Stock Exchange, providing for a minimum public float of 10 percent.

The planned share sale will increase the publicly held shares of Petron from the current 7.5 percent.

“We’re still studying (the planned share sale) and the timing. We have only proposals as of now. We are in talks with some banks for a possible placement,” Ang said.