MANILA, Philippines – The local stock market continued its winning streak for the fourth session on the back of upbeat global sentiment, lifting the main index back to the 5,400 levels and closer to all-time highs.

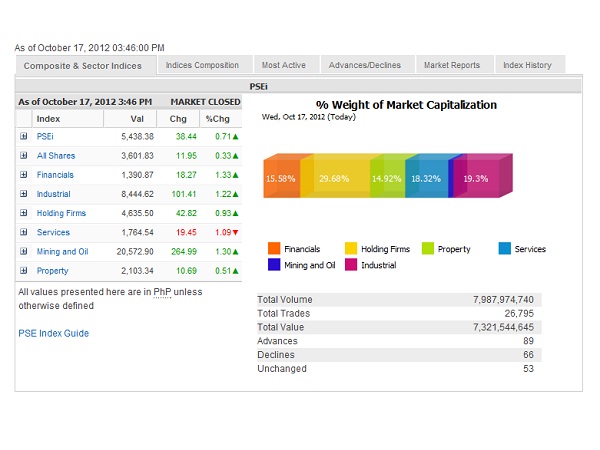

The main-share Philippine Stock Exchange index rallied by 38.44 points or 0.71 percent to finish at 5,438.38. The index is thus nearing the all-time high close of 5,443.74 posted on October 4 and the record intra-day high of 5,484.63 seen last October 5.

“Global markets are on a bull run,” said stock market veteran Wilson Sy, director of the fund management firm Philequity Management Inc.

All counters surged except for services (-1.09 percent), whose index was weighed down by index heavyweight PLDT (-1.03 percent) and ICTSI (-1.41 percent). The financial, industrial and mining/oil counters led the day’s upswing as their sub-indices climbed by over 1 percent.

Value turnover amounted to P7.32 billion. There were 89 advancers versus 66 decliners while 53 stocks were unchanged.

SM stocks particularly SMIC (+2.22 percent) and SM Prime (+2.38 percent) were briskly traded on the back of a consumer play. Other index gainers were Jollibee (+4.1 percent), BPI (+3.87 percent), URC (+3.43 percent), Megaworld (+2.5 percent), EDC (+1.94 percent), RLC (+1.25 percent), AC (+1.25 percent) and DMCI (+1.06 percent).

On the other hand, AGI, ALI and Manila Water succumbed to profit-taking alongside PLDT and ICTSI. Among non-index stocks, investors also locked up gains from Bloomberry (-7.21 percent), selling on news after the company discussed a masterplan for the gaming hub set to open by March 2013, the first in the Pagcor City complex.

Local investors took heart from rallying global markets as aninitial stream of US corporate earnings beat expectations. At the same time, investors were relieved that global credit watcher Moody’s Investor Service affirmed its Baa3 investment grade sovereign rating on Spain, which allayed concerns of downgrade to junk status.