China’s IMF boycott ‘a sign of things to come’—analysts

TOKYO—China’s to- level boycott of global financial meetings in Japan this week is a sign of things to come, analysts say, as an economically emboldened Beijing shows struggling Western nations it doesn’t need to play by their rules.

With global growth slowing, many in the developed world are looking to Beijing to pick up the slack, and the annual meetings of the International Monetary Fund and World Bank seemed a good place to press the point.

But while Tokyo was graced with global financial luminaries such as Timothy Geithner from the US and Wolfgang Schaeuble from Germany, China’s finance minister and central bank chief both stayed at home.

Beijing gave no official reason for sending their deputies, with foreign minister Yang Jiechi telling reporters in Beijing only that “the arrangement of the delegation for the meeting was completely appropriate.”

Observers say China’s stay-away was the result of a spat with Japan over disputed islands, and points to Beijing’s calculated willingness to use its financial muscle to make a political point.

“China made this decision by precisely weighing the disadvantages of the no-shows against the advantages of its presence,” said Yoshikiyo Shimamine, executive chief economist at Dai-Ichi Life Research Institute in Tokyo.

“It was an example of how China won’t always act within the Western-dominated framework and doesn’t see any contradiction between such absences and its responsibility as a major power,” he said.

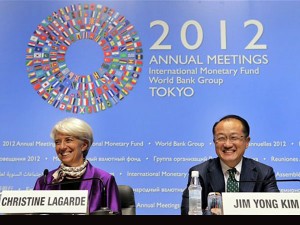

IMF chief Christine Lagarde rapped Beijing, saying it would “lose out” by not showing up, while World Bank President Jim Yong Kim urged the two countries to sort out their differences for the good of the global economy.

China – whose predicted growth of 7.8 percent this year is slower than the blistering pace of the last few years, but still leaps and bounds ahead of the West – merely shrugged.

In his report to a key committee that advises the IMF board, deputy central bank governor Yi Gang said the failure by Washington and Tokyo to fix their fiscal problems was the reason the global economy was struggling.

“Uncertainties related to fiscal sustainability weigh on sentiment and confidence, negatively affecting consumption, investment, and hiring decisions,” Yi said.

“The slow recovery in these major advanced economies poses costly spillover effects to the rest of the world,” he added.

While Chinese officials did take part in a number of meetings and seminars, their absence at a Japan-chaired lenders’ gathering on Myanmar was noted, with Tokyo saying it was “disappointing.”

Japanese politicians repeatedly urged Beijing to look at relations “from a broader standpoint.”

The dispute over Tokyo-controlled islands known as the Senkakus in Japan and the Diaoyus in China flared in August and September with landings by nationalists from both sides and the subsequent nationalization of the islands by Japan.

Street protests erupted in China, alongside consumer boycotts of Japanese goods, as reports emerged that firms were finding their China operations hampered by sudden extra red tape.

Japan’s big three automakers – Toyota, Nissan and Honda – reported plunging sales, while airlines said tens of thousands of bookings had been canceled.

Figures released in China this week showed trade with Japan slumped 1.8 percent to $248 billion for the year’s first three quarters, although the customs bureau made no link with the row.

Analysts say Beijing is likely to continue to conflate bilateral political issues with multilateral financial ones.

Yoshinobu Yamamoto, honorary professor of international politics at the University of Tokyo, said at a time when the world needed China to be paying attention, it was focused instead on the sovereignty spat.

“The move was intended to expose Japan to international pressure to solve the spat with China,” he said.

“For Beijing, the top priority is national governance. For the sake of this objective, China is likely to take similar action in the future.”

But some argue that China’s behavior is self-defeating because it will make it seem like a less attractive place to do business.

Some Japanese insurance firms have reportedly stopped offering coverage against riots for companies operating in China and manufacturers are said to be looking again at third countries as a base for operations.

Dai-Ichi Life’s Shimamine said Beijing runs the risk of cutting its nose off to spite its face.

“China’s policy of putting weight on politics has given the impression that China has risks and is not an easy country to deal with,” he said.