MANILA, Philippines – The Senate is now ready to start plenary debates on a measure that seeks to impose higher taxes on alcohol and tobacco products also known as “sin tax” bill, which is expected to generate P15 billion to P20 billion government revenues.

But even before the bill could reach the plenary, Senator Pia Cayetano protested what she described as “watereddown” version of the Senate.

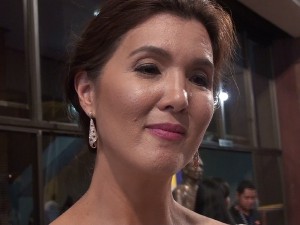

Cayetano said on Twitter: “Just saw the committee report on #sintax. I cannot accept it. It’s so watereddown. I will fight for a better version.”

Unlike the P31 billion revenue projection of the House of Representatives, the Senate committee on ways and means passed the bill with P15 billion to P20 billion expected revenue for the first year of its implementation.

“All told, our Committee Report predictably and responsibly could generate in the first year between P15 billion to P20 billion,” Senator Ralph Recto, chairman of the committee, said in a statement on Wednesday.

Recto said the government could yield between P9.8 billion to P14.8 billion in additional revenues from tobacco and as much as P5.2 billion to P7 billion from alcohol in the first year or in 2013.

“Whereas, the House version – HB 5727—based on the committee’s appreciation of the data and on the many runs or revenue scenarios conducted by DOF (Department of Finance) in the TWG (technical working group), would result [in] a loss of P300 million or a gain of P11.5 million for both cigarette and alcohol,” he said.

The original Palace version submitted to the House of Representatives, Recto said, would also redound to a loss of P5.13 billion or a gain of P7.4 billion based on the “runs” conducted by the DOF.

A 52 percent increase in the tax rates will be slapped on tobacco during the first year and an increase of 121 percent in the first tier or low-priced class – from P2.72 to P6 per pack.

“This tax formula is seen to generate anywhere between P10 billion to P15 billion in tobacco taxes, which is “predictable, recurring and fair to all stakeholders,” Recto said.

This would also result, he said, to a decrease in smokers by 8 percent on the average and possibly more from D and E classes;

“With respect to alcohol, the committee concurs with the House version as to the need to temper increases which will hike revenues between P5.2 billion to P7 billion,” Recto added.