With the corporate earnings season coming up, dealers were taking a cautious approach, while a cut in growth forecasts for the regional and world economy by the International Monetary Fund (IMF) also weighed on markets.

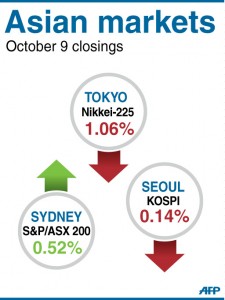

Sydney rose 0.52 percent, or 23.4 points, to close at 4,505.3 – a 14-month high thanks to rising iron ore prices. Seoul eased 0.14 percent, or 2.85 points, to 1,979.04 and Tokyo fell 1.06 percent, or 93.71 points, to 8,769.59.

Hong Kong rose 0.54 percent, or 112.72 points, to 20,937.28. Shanghai advanced 1.97 percent, or 40.81 points, to 2,115.23, with the market also helped by a huge central bank injection of funds aimed at boosting liquidity.

Monday saw markets around the world slump on concerns about the eurozone, with Spain still refusing to ask for a bailout and Greece deadlocked in talks with its creditors over its next tranche of rescue funds.

In Shanghai, dealers were betting that China’s leaders will unveil a fresh set of measures to boost the economy, especially with a date for a handover of power penciled in for early next month.

The composite index fell on Monday owing to disappointment over manufacturing data that came out last week, when traders were on holiday. The government’s purchasing managers’ index edged up to 49.8 in September from 49.2 in August – a slight improvement but still below the 50 mark, indicating contraction.

“The latest economic data, albeit weak, did show signs of stabilization, and that gives investors some confidence,” said Shenzhen Zhongzheng Investment Consulting analyst Zhang Suoqing.

“Expectations are heightened that more stimulus measures will be introduced.”

The upbeat outlook had a knock-on effect for Hong Kong, marking its sixth gain in seven sessions.

However, shares in Tokyo, which was closed Monday for a public holiday, slipped as the yen, which rose in New York against the euro on European debt fears, hurt exporters.

The euro fell on forex markets, changing hands at $1.2930 and 101.31 yen in Europe, against $1.2967 and 101.57 yen in New York late Monday.

The dollar was trading at 78.34 yen compared with 78.31 yen in US trade.

“Friday’s US payroll figures were certainly a positive surprise, but still not that great when put into a broader context. They still don’t afford much of a sense of security,” said Naoki Fujiwara, fund manager at Shinkin Asset Management in Tokyo.

“Trepidation ahead of… earnings results, and the IMF’s cut of its global economic growth forecast, are hurting the market,” he told Dow Jones Newswires.

The United States on Friday released figures showing the unemployment rate at 7.8 percent in September, its lowest in almost four years and lifting hopes for the economy.

But concerns about the global recovery were underlined on Tuesday, when the IMF cut its growth projections for the global economy and said things could worsen if the eurozone crisis is not resolved.

It also reduced its outlook for China, Japan and developing Asia, warning of the knock-on effects from Europe as well as the weak impact of monetary easing measures.

On oil markets New York’s main contract, light sweet crude for delivery in November, was up 85 cents to $90.18 a barrel in afternoon trade. Brent North Sea crude also for November advanced 73 cents to $112.55.

Gold was at $1,772.30 at 1000 GMT compared with $1,768.00 on Tuesday.

In other markets:

— Singapore closed 0.35 percent, or 10.74 points, lower at 3,065.91.

Singapore Telecom was unchanged at Sg$3.19 and Singapore Airlines eased 0.85 percent to Sg$10.56.

— Taipei fell 0.31 percent, or 23.88 points, to 7,592.01.

Taiwan Semiconductor Manufacturing Co. shed 2.24 percent to Tw$87.1 while leading smartphone maker HTC was 7.0 percent limit-down at Tw$267.0.

— Manila closed 0.72 percent lower, shedding 39.23 points to 5,394.90.

Philippine Long Distance Telephone fell 1.09 percent to 2,730 pesos and Metropolitan Bank and Trust dropped 2.33 percent to 90.30 pesos.

— Wellington slipped 0.41 percent, or 15.92 points, to 3,907.99.

Fletcher Building was off 2.4 percent NZ$7.30 and Telecom closed down 0.63 percent at NZ$2.37.

— Jakarta rose 0.28 percent, or 12.02 points, to 4,280.25.

Gold miner J-Resources gained 9.5 percent to 5,750 rupiah, car maker Astra rose 1.3 percent to 8,200 rupiah and gas distributor Gas Negara added 2.3 percent to 4,250 rupiah.

— Kuala Lumpur added 0.19 percent, or 3.10 points, to 1,663.32.

YTL Power International gained 1.9 percent to 1.64 ringgit while Sime Darby added 1.2 percent to 9.78 ringgit. MMC Corp. eased 1.9 percent to 2.63 ringgit.

— Bangkok slipped 0.94 percent, or 12.23 points, to 1,292.48.

Electricity firm EGCO fell 1.12 percent to 132 baht, while Siam City Cement dropped 1.40 percent to 353 baht.

— Mumbai rose 0.45 percent, or 84.38 points, to 18,793.36.

Engineering giant Larsen and Toubro rose 2.06 percent to 1,628.7 rupees while Infosys rose 1.85 percent to 2,536.95.

Cash-strapped Kingfisher Airlines fell 4.76 percent to 12.00 rupees, its seventh straight day of losses as striking workers refused to return to work without payment of salaries, keeping the flights grounded since last week.