Pangilinan bid to acquire GMA 7 falls through

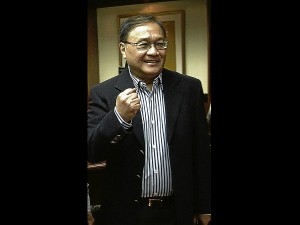

MANILA, Philippines—Manuel V. Pangilinan’s bid to acquire a controlling stake in the local broadcasting company GMA Network Inc. has ended in failure.

The Philippine Long Distance Telephone Co. group disclosed to the Philippine Stock Exchange on Thursday that MediaQuest Holdings Inc., a company owned and controlled by the PLDT Retirement Fund, has terminated discussions with the major shareholders of GMA Network.

“The parties have been unable to arrive at mutually acceptable terms despite the continual discussions and efforts exerted in good faith,” the PLDT disclosure said, without discussing what went wrong with the discussions. A separate disclosure from GMA7 contained the same message.

Pangilinan, who chairs PLDT, said in a separate statement that the termination of the GMA acquisition initiative was “expected to adversely impact the PLDT group’s strategy of evolving from a traditional telecommunications company into a multimedia service company.”

“The PLDT Group continues to believe that owning, producing and providing content across multiple platforms is an important component of its blueprint for growth and as such, intends to pursue its media strategy by building on MediaQuest’s current investments in TV 5, the country’s third largest free-to-air television network by audience share, and Cignal TV, the leading provider of direct-to-home satellite television services,” he added.

Article continues after this advertisementIndustry sources said the termination had nothing to do with Pangilinan’s recent threat to relocate back to Hong Kong or pull out investments in the Philippines, noting that discussions had hit a stalemate even before that.

Article continues after this advertisementThe Inquirer’s Biz Buzz reported in early September that after moving close to an acceptable pricing of about P52.5 billion (enterprise value for 100 percent of GMA-7), a potential deal-breaker was the amount of advance payment that sellers wanted Pangilinan’s group to lay on the table ahead of congressional approval to consummate the deal.

Knowing that the deal may encounter rough sailing among regulators, Pangilinan’s group was not willing to shell out a big amount that could be forfeited if regulators opposed the deal.

Last August, GMA7 chair Felipe Gozon told reporters that the discussions with Pangilinan’s group would either terminate or go through within this year. If a deal did not push through, he said, the current owners of GMA7 were “ready, prepared and willing to continue running” the company.

Gozon, for his part, has been at the helm of GMA7 for 12 years.