MANILA, Philippines—Most local stocks retreated on Monday on profit-taking and a weak regional sentiment arising from sluggish data from China and Japan.

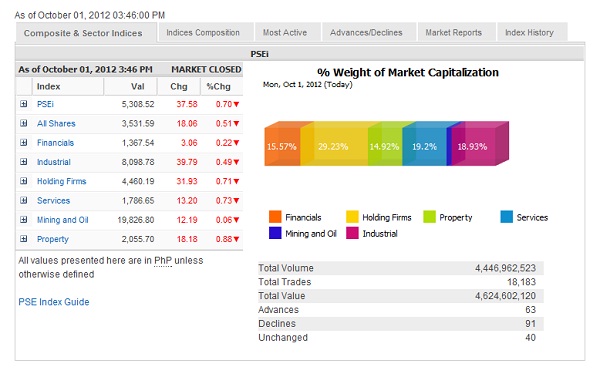

The main-share Philippine Stock Exchange gave up 37.58 points, or 0.7 percent, to close at 5,308.52. All counters were in the red.

Dealers were expecting local stocks to pull back this week after surging close to record highs last week. Local trading also tracked weak regional sentiment on unfavorable Japan consumer confidence report and China factory data.

At the same time, key markets like China, Hong Kong and South Korea were on public holiday break on Monday, muting trading across the region.

At the local market, value turnover was thin at P4.62 billion. There were 63 advancers that were beaten by 91 decliners while 40 stocks were unchanged.

The main index was weighed down most by URC (+4.09 percent), ALI (-2.31 percent), JG Summit (-1.69 percent), AC (-1.69 percent), Globe Telecom (-1.47 percent) and FGen (-1.4 percent).

SM Prime, AP, PLDT, JFC also contributed to the day’s decline.

On the other hand, index losses were tempered by the gains eked out by Belle (+3.21 percent), RLC (-1.68 percent) and EDC (-0.33 percent).

Belle has been rising on expectations of a nearing closing of a buy-in deal with Macau casino group Melco on the Belle Grande project.