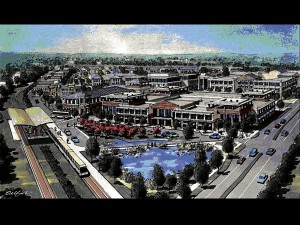

GREEN home mortgages confirm that a green building program can encourage homebuyers to choose green-rated homes with up to 50 percent reduced utility bills like in this Austin, Texas energy-saving and transit-oriented housing project. Photo from activerain.com

Better and more permanent living conditions have enticed humans to move to urban settlements for thousands of years now. After reaching a particular size, these settlements engaged in collective activities including control over planning and development.

Before industrialization 90 percent of the population was agriculturally based. Today it is only 10 percent of the population who are rurally based in advanced countries.

The city’s expansion was driven by modern means of transportation leading to urban sprawl as many prefer to live far away from their workplaces. There is rethinking of this lifestyle because of the price of gas and the level of carbon emissions.

The biggest change caused by industrialization is the complete dependence on nonrenewable, fossil-fuel based energy sources. Fired by our expanding appetite for comfort and consumer goods, we direct the warming of the planet.

Regulated planning is over our heads now, and modern urban sustainability has become a concern even for schoolchildren.

Energy Star program

Thirty years ago the people of Austin, Texas avoided building a new community-owned electrical power plant. Instead they initiated the Energy Star program for rating the energy consumption of new homes. Architects, engineers and developers were encouraged to design and produce homes that went above the minimum energy-use requirements of their building code.

The program produced a standardized way of comparing new homes which received one, or two, or three stars and homebuyers became very conscious of this award.

Why focus on rating the energy consumption of new homes?

In the United States, homes account for a quarter of greenhouse emissions. This is the reason they are adopting strategies to reduce their emissions. Although our country is not a major greenhouse emitter, our government recognizes that we should take a more active role in mitigating the effects of climate change by changing to renewable energy resources.

The factors included in the energy-use rating program in Austin, Texas were insulation, glazing effects, sun shading, lighting and ventilation, heating and cooling, systems efficiency, fuel source, materials used, water conservation and waste disposal. These green building elements are held in common by the Philippine Green Building Initiative or PGBI, a local green building rating system available.

As government, business and the local citizenry get engaged in a green building program, like in the city of Austin, the awareness can move a notch higher into other sustainable community initiatives.

Green mortgage

This mentality has hit not only the community and the environment, but also the bank and this is where green mortgage comes in.

What is green mortgage? A green mortgage, sometimes called an energy-efficient mortgage, is a type of loan that homeowners can avail themselves of to reduce their monthly utility bills by allowing them to finance the cost of installing energy-efficient features in the new house they are buying or when refinancing an existing one.

Energy-efficient or energy improvement mortgages, first introduced in 1980, are new loans being offered abroad. Providing borrowers with standards for structuring green mortgages is finding its way even into the secondary market.

Green vs conventional loan

The basic difference between the two types of loan is that a green loan or mortgage requires an energy audit. This is a procedure done for homes by a technical team to objectively evaluate the energy use of the house and making recommendations to increase the energy performance of the house.

The cost of the energy audit for homes is a part of the bank loan and may take only a few days to complete. The results of the energy audit can then be used when applying for a green mortgage.

Passing an energy audit conducted by accredited professionals can lead to earning tax deductions and other incentives from cities now. Bank borrowers can also qualify for bigger loan amounts, and higher monthly amortizations because of energy savings in green-rated homes. The mechanics differ between banks.

The appearance of green home mortgages in the market has confirmed the fact that an energy or green building program can reduce utility bills in homes by 30-50 percent.

For comments or inquiries, email amadodejesus@gmail.com.