NEW YORK—US stocks sank Wednesday following the paths of markets in Asia and Europe amid a rise in turmoil in the eurozone.

Losses were broad-based, with most tech leaders and Dow blue chips losing ground.

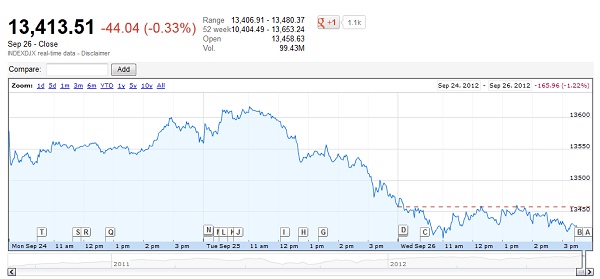

At the end of trade, the Dow Jones Industrial Average was down 44.04 points (0.33 percent) at 13,413.51.

The S&P 500 lost 8.27 (0.57 percent) at 1,433.32, while the Nasdaq Composite shed 24.03 points (0.77 percent) at 3,093.70.

“European markets were mostly lower coming into the open this morning, and that certainly put downward pressure on our markets,” said Joe Bell of Schaeffer’s Investment Research.

“Some malevolent forces are rearing their ugly head again,” said Patrick O’Hare at Briefing.com.

“In particular, worries about the eurozone are front and center as protests over austerity measures flare up in Spain and Greece. Meanwhile, the US equity market seems to be recoiling at the thought that central bank support might not be the saving grace many had hoped it would be.”

Among large-cap shares, Bank of America slipped 1.2 percent, American Express 1.7 percent, Apple 0.9 percent and Oracle 1.9 percent.

Struggling Hewlett-Packard bucked the trend and added 2.4 percent after losing ground for a week.

BlackBerry maker Research in Motion surged 6.1 percent after saying it had added two million new subscribers since June, holding on in its fight against rival smartphone makers.

Yahoo! fell 0.4 percent to $15.68 a day after new chief executive Marissa Mayer spelled out the company’s mission to staff and announced a new chief financial officer.

Troubled electronics chain RadioShack gained 1.6 percent a day after the company sacked its chief executive and launched a search for a new leader.

Electric sports car maker Tesla fell 0.4 percent after its revelation Tuesday of being well behind on its production schedule.

Bond prices were higher. The 10-year Treasury yield fell to 1.62 percent from 1.68 percent Tuesday, while the 30-year held flat at 3.03 percent. Bond prices move inversely to yields.