MANILA, Philippines—Most local stocks dipped in lackluster trade on Tuesday, tracking cautious regional markets amid lingering global growth woes.

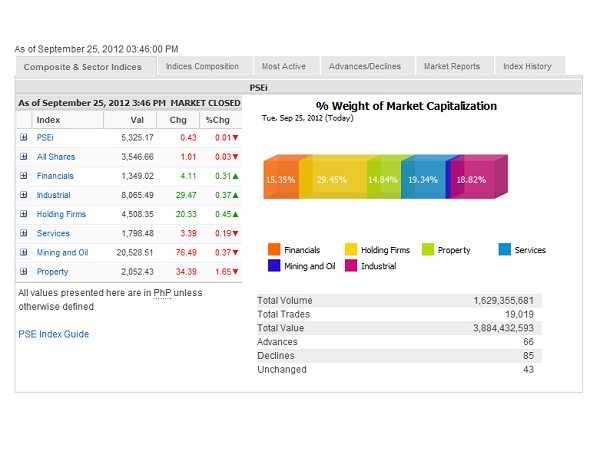

The main-share Philippine Stock Exchange index shed 0.43 points, or 0.01 percent, to close at 5,325.17, returning to the doldrums after Monday’s bounce.

After boosting the index in the previous session, the property counter succumbed to profit-taking, declining by 1.65 percent and dragging the main index the most.

Services and mining/oil counters likewise ended lower.

On the other hand, modest gains by the financial, industrial and holding firm counters tempered the day’s losses.

Value turnover was very low at P3.88 billion. There were 66 advancers, which were overwhelmed by 85 decliners, while 43 stocks were unchanged.

The biggest index decliners were ALI (-2.86 percent), SM Prime (-1.12 percent) and Belle Corp. (-1.05 percent). PLDT, DMCI, BPI and SMC “A” also contributed to the decline.

On the other hand, the biggest index gainers were URC (+2.49 percent), Metrobank (+1.65 percent), SMIC (+1.1 percent) and AGI (+1.02 percent). BDO, SM JG and Philex also contributed small gains.

Among the second-liners, one out-performer was Bloomberry (+4.59 percent) while FPH and Tanduay also moved higher in relatively heavy trade.