PSEi falls below 5,200 on global growth concerns

MANILA, Philippines—The local stock index slipped below 5,200 on Tuesday as global growth concerns tempered risk-taking across regional markets.

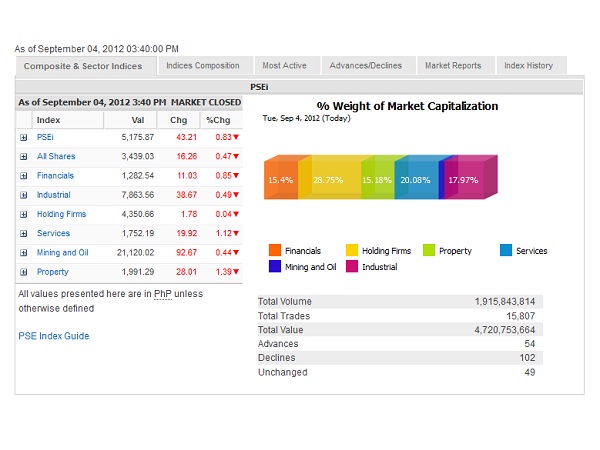

The main-share Philippine Stock Exchange index slumped by 43.21 points, or 0.83 percent, to close at 5,175.87.

All counters declined but the most battered were the services and property counters, which respectively fell by 1.12 percent and 1.39 percent.

Value turnover amounted to P4.72 billion. There were 54 advancers, which were overwhelmed by 102 decliners while 49 stocks were unchanged.

The main index was weighed down by PLDT (-1.09 percent), ALI (-1.97 percent), BDO (-1.57 percent), SM Prime (-1.29 percent), DMCI (-1.47 percent), Philex (-1.66 percent) and BPI (-2.03 percent).

Metrobank, MPI and SMC “A” (open only to local investors) also contributed to the PSEi’s drop.

Among non-index stocks, Bloomberry (-1.86 percent) declined in heavy volume.

On the other hand, the PSEi’s fall was cushioned by the gains of SMIC (+1.05 percent), AGI (+0.17 percent), AC (+0.24 percent) and URC (+1.15 percent).

Security Bank, GT Capital and Puregold also advanced in heavy trade.

In a weekly research, Metrobank said the domestic bourse would likely trade sideways with investors watching for firmer leads.

“News flows abroad due out this week are ISM manufacturing index, jobless claims, unemployment rate, and changes in non-farm payrolls,” the bank said.

“On the local side, August inflation data will be out on Wednesday. Consensus estimate for August CPI (consumer price index year on year) is at 3.5 percent; prior month was at 3.2 percent,” Metrobank said.

Meanwhile, the Reserve Bank of Australia cut key interest rates on Tuesday to 3.5 percent from 3.75 percent as a global slowdown has been seen gnawing at its resources-led expansion. Regional and global growth concerns thus dampened investor sentiment.

US markets were closed on Monday as America paused to observe Labor Day.