MANILA, Philippines—The Bangko Sentral ng Pilipinas is gearing up for a potential rise in currency speculation following the economy’s above-target growth performance in the first semester.

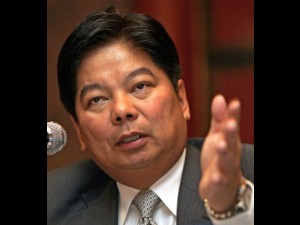

BSP Governor Amando Tetangco Jr. said that speculative activities, particularly those that bet on the peso’s further appreciation in the coming months, could rise as capital markets manifest upbeat sentiment over the Philippines.

He said the central bank is keenly monitoring market developments and is prepared to impose more regulations to avoid “destabilizing market activities.”

“Favorable growth prospects in the Philippines bode for more foreign exchange inflows to our part of the world as economic outlook for the advanced economies continues to be weak,” Tetangco told the Inquirer Friday.

The economy, measured in terms of gross domestic product, grew by 6.1 percent in the first semester. The government has set its full-year growth target at 5 to 6 percent.

“We are monitoring developments, including market behavior, to ensure excesses are addressed. There is room in our policy toolkit to address unwarranted movements in the markets,” Tetangco added.

In January, the BSP imposed higher capitalization requirement on banks’ holdings of nondeliverable forwards (NDFs)—a hedging instrument meant for clients of banks engaged in export and import activities—to discourage excessive investments in them.

In particular, the central bank slapped a 15-pecent capital adequacy ratio (CAR) requirement for NDF holdings of banks, higher than the 10 percent capital cover required for other assets.

The BSP believed some banks were accumulating NDFs not only to serve hedging needs of clients but also to earn from peso speculation. This belief was anchored on the surge in trading volumes for NDFs in late 2011.

Following the imposition of higher capital charge, however, the BSP said trading volumes have started to normalize.

In July, the BSP prohibited money owned by foreigners from being invested in its special deposit account (SDA) facility. This was in response to the belief that peso buying in the foreign exchange market could have risen partly due to speculation on the local currency’s further appreciation.

The BSP said making the SDA facility accommodate only domestic funds would help address speculation on the peso.

Tetangco said the central bank is poised to implement more measures against excessive currency speculation should it see signs of this following the release last week of the government’s report on the economy’s performance for the first half of the year.

Although rising investments in peso-denominated instruments are welcome because these help make the country’s capital markets active and vibrant, the BSP said too much speculation should be tempered because of its destabilizing effects, including sharp volatility of the exchange rate.

The BSP said it does not have a bias in favor of a strong or weak peso, but stressed that sudden and too much volatility of the exchange rate hurts businesses and the economy.