Asia stocks down ahead of US Fed chief’s speech

TOKYO — Asian markets were little changed in cautious early Tuesday trading, stalled by global worries about the impact of the eurozone debt crisis as investors awaited the release of key U.S. economic data.

The Tokyo Stock Exchange’s benchmark Nikkei was fell 0.1 percent to 9,072.79. South Korea’s Kospi index lost 0.2 percent to 1,913.21. Hong Kong’s Hang Seng Index fell nearly 0.3 percent to 19,746.13. Australia’s S&P/ASX 200 rose marginally, however, to 4,346.10.

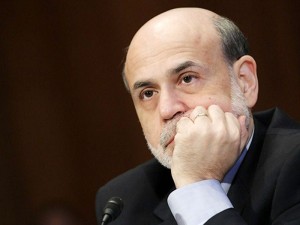

Nobuhiko Kuramochi, head of the investment information department at Mizuho Securities Co. in Tokyo, said that traders were not going to make major moves ahead of key events later in the week, including U.S. Federal Reserve Chairman Ben Bernanke’s speech in Wyoming.

Traders were also looking ahead to the release of U.S. April-June gross domestic product data set for Wednesday.

“Attention is on how overseas markets are faring as those herald major risks,” Kuramochi said. “With Japanese exports already declining, they will determine the momentum of manufacturing issues.”

Stock markets in London were closed Monday for a bank holiday, dampening trading activity.

Overnight, Wall Street remained subdued, awaiting signals from the Fed about possible help for the economy.

The Dow Jones industrial average fell 0.3 percent to 13,124.67. The Standard & Poor’s 500 Index fell 0.69 point, or 0.05 percent, to 1,410.44. The Nasdaq composite index rose 0.1 percent to 3,073.19.

Investors are waiting on prospects for more economic stimulus from central banks in China and the U.S. and a financial stability plan from the European Central Bank.

Economists have been warning the debt crisis in the 17-country eurozone could eventually catch up with Germany. Troubles elsewhere are starting to make themselves felt. Italy and Spain, the No. 3 and No. 4 eurozone economies, are in recessions as they try to reduce budget deficits and struggle to refinance their debts in bond markets.

So far, exports of cars and industrial machinery to stronger economies in Asia and the U.S. have helped Germany grow, while low unemployment has buoyed consumer spending at home. But those advantages may not be enough for much longer against the undertow from the eurozone crisis.

The question of how to avert a Greek debt default, which could spark a chain reaction among other ailing European economies, has preoccupied EU leaders as they return from their summer break.

Benchmark oil for October delivery fell 14 cents to $95.33 per barrel in electronic trading on the New York Mercantile Exchange. The contract fell 68 cents to close at $95.47 on the Nymex on Monday.

In currencies, the euro fell to $1.2475, down from $1.2503 late Monday in New York. The dollar fell to 78.58 yen from 78.75 yen.