MANILA, Philippines—Local stocks bounced on Tuesday as prospects of local monetary easing tempered lingering jitters from the eurozone.

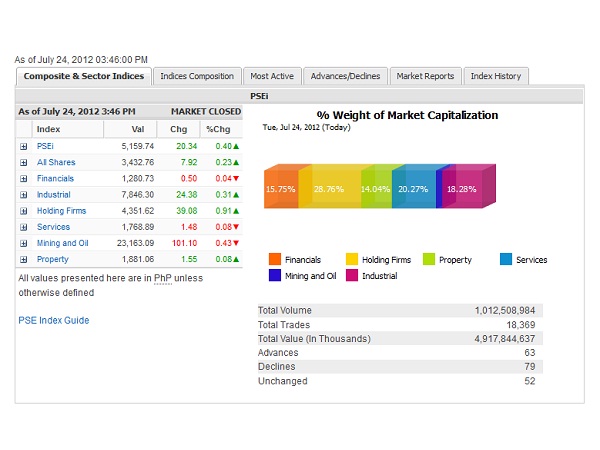

The main-share Philippine Stock Exchange recouped 20.34 points, or 0.4 percent, to close at 5,159.74, overcoming the weakness in the morning session.

The main index was supported by modest gains eked out by the industrial, holding firm and property counters. On the other hand, the financial, services and mining/oil counters remained in the red.

Trading was mixed across the region after Moody’s placed Germany, Netherlands and Luxembourg on a “negative” credit watchlist as the EU debt concerns persisted. Spain’s bond yields also spiked after one of its regions sought financial aid from Madrid.

Dealers said the Bangko Sentral ng Pilipinas’ statement on Tuesday, which saw scope for monetary adjustment brought some relief to the market. The central bank is seen to be turning “dovish” or biased for monetary easing.

On the other hand, President Aquino’s State of the Nation Address on Monday was welcomed by businessmen but offered little catalyst to the market.

Investors picked up shares of Ayala Corp., Metrobank, ALI, SM Investments, First Gen, AGI, EDC, URC, DMCI and Megaworld. Non-index stock FPH also traded higher in heavy trade.

On the other hand, the PSEi’s gains were curbed by the share price decline in BDO, PLDT, AEV, ICTSI, BPI, AP and SM Prime. Second-liners Puregold and Security Bank also ended lower.

Value turnover for the day amounted to P4.9 billion. Despite the overall index rise, decliners outnumbered gainers 79-63, suggesting selective buying at the market.