Pangilinan willing to pay a premium for GMA 7

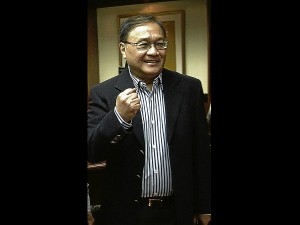

MANILA, Philippines—Businessman Manuel V. Pangilinan said Friday his group was willing to buy local broadcasting giant GMA Network Inc. (GMA 7) at a price higher than how much the stock market was currently valuing the company.

As of Friday’s close, GMA 7 has a market capitalization of P33.95 billion based on outstanding common stocks, on top of which were Philippine depositary receipts (PDRs) worth P8.7 billion.

The Inquirer earlier reported that Pangilinan’s group was moving closer toward a deal to acquire GMA 7 for P52.5 billion based on an enterprise value for the entire company, close to 80 percent of which may be acquired from controlling shareholders.

“We’re still in discussions,” the chair of Philippine Long Distance Telephone Co. told reporters at the sidelines of the launch of the 2012 search for Ten Outstanding Young Men of the Philippines.

Pangilinan was reluctant to talk about pricing issues and only smiled when asked whether he had a price tag in mind. “It will be higher than the existing market capitalization,” he said.

Article continues after this advertisementAs to when a deal may be firmed up, Pangilinan said: “It’s difficult to predict.”

Article continues after this advertisementPangilinan said Mediaquest Holdings would likely be the vehicle to be used in acquiring GMA 7 although ePLDT Inc. could purchase the PDRs. Pangilinan answered in the affirmative when asked if the group would expand the balance sheet of Mediaquest for this acquisition.

Mediaquest is a unit of the Beneficial Trust Fund of PLDT that was also used as a holding firm for media assets such as the stake in Associated Broadcasting Co. (TV5) and minority interest in various national newspapers.

Asked whether PLDT was considering to place out shares to the open market to raise fresh funds, Pangilinan said there was “no contemplation of raising debt or equity at the PLDT level.”

The prospective acquisition of GMA 7 is seen giving Pangilinan’s group a leading market position in the broadcasting industry for convergence with the flagship telecommunication enterprise.

The earlier estimated P52.5-billion price tag for the acquisition, INQUIRER sources said, was based on an “enterprise value” for 100 percent of GMA 7. Enterprise value factors in preferred stocks, debt and cash reserves that are usually not captured by mere market capitalization. In this case, the package includes 1.5 billion preferred shares that have five times more voting rights than common shares (now at 3.36 billion) but convertible at par to common shares at a 1:1 ratio.

GMA 7 is controlled by three families–the Jimenez, Duavit and Gozon clans. After buying out the controlling stockholders, Pangilinan’s group is also expected to make a tender offer to minority investors.

Pangilinan, who is also managing director of PLDT’s controlling stockholder First Pacific Co. Ltd., earlier said his group would likely pay for the acquisition in cash.