MANILA, Philippines—Most local stocks slumped for a third straight session on Thursday, bucking an upswing in the region, as investors paused to await the local second-quarter corporate earnings season.

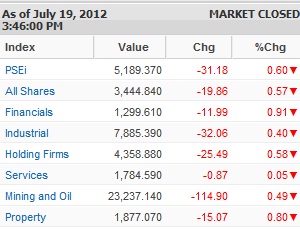

The main-share Philippine Stock Exchange index gave up early session gains to close 31.18 points, or 0.6 percent, lower at 5,189.37 in thin trade.

Although most other markets have benefited from improved risk appetite, the local market had to take a breather after a sharp run-up to new highs recently, dealers said. Also, recent overnight placements by companies such as Ayala Land Inc., Pure Gold and Ayala Corp. have sucked some of the liquidity in the market.

All counters ended in the red. Value turnover amounted to P4.69 billion. There were about two stocks that declined for every single one that gained.

The main index was led lower by Ayala Corp., which fell by another 1.1 percent as the market caught up with the P430-per share pricing of an overnight sale of treasury stocks by the conglomerate on Tuesday.

SM Investments, DMCI, Metrobank, Megaworld, Aboitiz Power, ICTSI, SM Prime, URC, BDO, Meralco and AGI also contributed to the PSEi’s decline.

Non-PSEi stocks Bloomberry and Security Bank also fell in heavy volume.

On the other hand, the PSEi’s decline was tempered by the modest gains of Globe, PLDT and JG Summit. GT Capital and Abacus also gained.

In its daily research note, Metrobank said that while Wall Street extended its gains to a second day on Wednesday on the back of strong tech stocks performance and US Fed chairman Ben Bernanke’s openness to injecting monetary stimulus, most investors might “stay on the sidelines as they await for second-quarter corporate earnings.”