Philippine stocks down 1.22%

MANILA, Philippines—Local stock prices tumbled sharply on Wednesday as a treasury share sale by a blue chip company was seen as a signal of a “toppish” market while gloomy US outlook dampened appetite across the region.

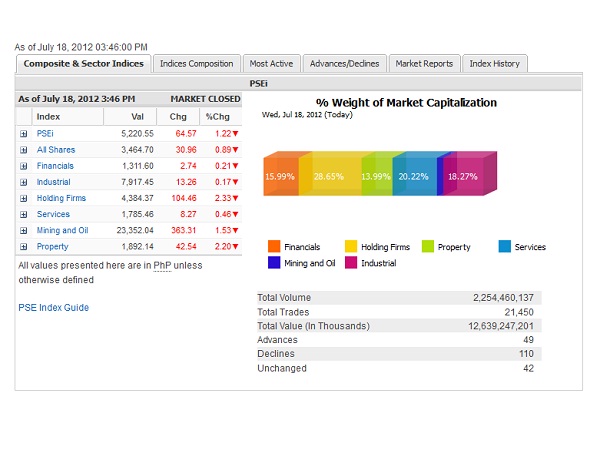

The main-share Philippine Stock Exchange index shed 64.57 points, or 1.22 percent, to finish at 5,220.55, led lower by Ayala Corp. (-5.02 percent).

Ayala lost P23 to close at P435 per share after an overnight deal to sell 15 million treasury shares at a 6-percent discount to Tuesday’s close. As companies tend to buy back shares for their treasury portfolio when they deem that its shares are undervalued, the sale of those shares back to the open market may be a signal that the market is peaking, several fund managers said.

“All these share placements will be an overhang for the markets,” said a foreign fund manager.

Turnover amounted to P12.64 billion, including the cross of Ayala’s P6.45-billion treasury sale.

Article continues after this advertisementThere were about two decliners for every single gainer in the market.

Article continues after this advertisementBefore Ayala’s treasury sale, its property arm Ayala Land Inc. also recently placed out P13.6 billion secondary shares in an overnight deal. Shareholders of Puregold, a newly listed but closely followed stock, also recently sold P6.5 billion worth of secondary shares. There were rumors that more big companies would follow suit.

Global growth woes also gnawed at investor sentiment. Most other stock markets in the region faltered after the chief of the US Federal Reserve, Ben Bernanke, painted a gloomy view of the US economy even as he hinted that the US central bank would be open to further monetary stimulus.

Wall Street is awaiting a third round of quantitative easing—or bond buybacks to infuse additional liquidity when targeted fund rates are already at near-zero lows—by the US Fed within this year.

At the local market, shares of index stocks PLDT, ICTSI, Megaworld, MPI, SMIC, Metrobank, ALI, AGI, FGEN, BDO, URC, JG Summit, Philex, EDC and SM Prime also closed lower on Wednesday. Puregold shares also declined.

On the other hand, the few stocks that bucked the downturn in heavy volume were led by DMCI, MWC and Security Bank.