MANILA, Philippines—Local stocks dipped for a third session on Tuesday as jitters over China’s slower-than-expected import growth added to pressures from a technical correction after the main index hit record highs last week.

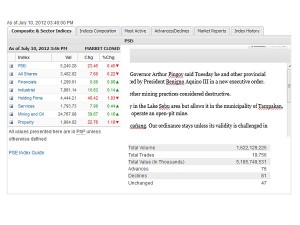

The Philippine Stock Exchange index lost 23.46 points, or 0.45 percent, to finish at 5,240.28 in mixed trade.

The holding firm and property counters dragged down the market as their indices both fell by over 1 percent.

On the other hand, the financial, industrial, services, and mining and oil sectors were marginally higher. Dealers said the market was hardly excited over the newly issued mining executive order.

Value turnover amounted to P5.18 billion. There were 76 advancers, which were edged out by 81 decliners, while 47 stocks were unchanged.

The local stock market was modestly higher in the morning session but faltered in the afternoon as investors digested news that China’s imports grew by only 6.3 percent in June, about half of what analysts were expecting. Prospects of China buying less than expected from the rest of the world added to profit-taking pressures at the local market.

In terms of specific stocks, ALI, SM Prime, AC, DMCI, AGI, BPI and EDC contributed to the PSEi’s decline. ALI, the most actively traded stock, shed 2.55 percent.

The non-index stocks that had fallen in heavy trade were Bloomberry and Lepanto.

On the other hand, the day’s decline was tempered by the gains eked out by PLDT, URC, SMIC and Metrobank.

Among the notable gainers were FPH (+2.68 percent) as well as mining stocks NiHao (+6.12 percent) and Dizon (+6.71 percent).

“The release of the highly anticipated mining EO yesterday did not offer any reprieve for mining stocks (and for the market, in general) as investors saw its contents to be detrimental to the miners’ earnings,” Metrobank said in its daily note.

The bank was expecting another day of decline given that Wall Street also marked its third straight day of losses overnight. “Possible continued peso depreciation may also prompt foreign players to trim their equity positions,” Metrobank said.