MANILA, Philippines — The local stock index closed at a new record high on Thursday as news about Standard & Poor’s sovereign credit rating upgrade on the Philippines and benign local inflation cushioned against a regional downtrend.

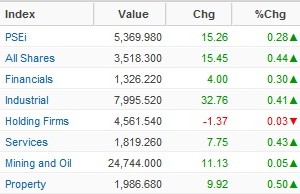

The main-share Philippine Stock Exchange index gained 15.26 points or 0.29 percent to close at a 5,369.98, a new all-time high closing.

Value turnover amounted to about P5.2 billion. There were 91 advancers that beat 59 decliners while 50 stocks were unchanged.

Most counters were modestly higher. Only the holding firm counter was slightly in the red.

“Share prices went up due to the reports that we got an upgrade from S&P,” said Manny Cruz, chief strategist at Asiasec Equities. “The biggest gainers were casino-lined stocks.”

“For the near term, we’re expecting the market to have a heavy resistance at the recent high (all-time intra-day high) of 5,403. We’re looking for support at 5,327 and 5,272,” Cruz said.

Index stocks SM, Megaworld, Metrobank, PLDT, AC, Metro Pacific, AGI, SM Prime and AP led the PSEi higher. However, the best performer among the 20 most actively traded stocks were LR and Belle, which were respectively up by 6.83 percent and 3.85 percent to P9.23 and P5.40.

The market was anticipating the SM group, which has a majority interest in Belle, to announce a deal with Macau’s Melco Crown Entertainment.

Likewise among the gainers were Bloomberry (+2.41 percent), Security Bank (+0.77 percent), Puregold (+0.35 percent) and Dizon (+2.63 percent).