Philippine stocks bounce back

MANILA, Philippines—The local stock index bounced from an early slump to break the 5,100 barrier on Wednesday as growing expectations of another coordinated monetary easing by US and European central banks boosted the appetite for selective buying.

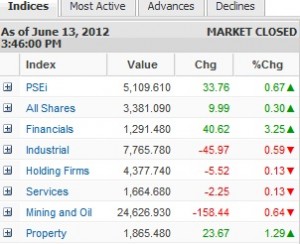

The main-share Philippine Stock Exchange index gained 33.76 points, or 0.66 percent, to close at 5,109.61.

“As it turns out, the June 12 holiday was good. We sat out Wall Street’s angst. Now that Spain’s bank bailout has been digested, market should be better,” said First Metro Asset Management president Gus Cosio.

Sentiment was mixed across counters, with cyclical and interest rate-sensitive counters like financial and property sub-indices surging by 3.2 percent and 1.28 percent, respectively, while all the rest were in the red.

Turnover amounted to P6.68 billion. Despite the overall index gain, there were more losers (95) than gainers while 34 stocks were unchanged.

Investors took their cue from upbeat trading on Wall Street overnight, which perked up the Dow Jones Industrial Index by 162.57 points, or 1.31 percent, as well as the slightly positive Dow Jones futures. Global markets are betting that the US Federal Reserve and the European Union would be prompted to undertake more monetary easing as risks of a eurozone breakup escalated.

At the local market, gains by SMIC, DMCI, AC, ALI, Metrobank, Megaworld, BDO, Globe and Manila Water supported the PSEi.

Newly listed Calata also traded higher in heavy volume alongside Security Bank and Puregold.

On the other hand, the index gains were tempered by the decline in PLDT, AGI, URC, SM Prime and EDC. Bloomberry and Lepanto “A” (open only to local investors) also closed lower.