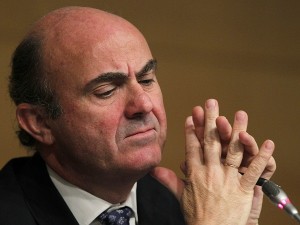

Spain's Economy Minister Luis de Guindos gestures during a news conference at the Ministry of Economy and Competitiveness in Madrid, Spain, Saturday, June 9, 2012. Spain asked for a European rescue of its troubled banks holding an emergency conference call with European finance ministers, a move that turned the nation into the fourth from the 17-nation eurozone to seek outside help since the continent's financial crisis erupted two years ago. AP/Andres Kudacki

MADRID – Spain has secured a European lifeline of up to 100 billion euros ($125 billion) to save its stricken banks and try to avert a broader financial catastrophe after emergency talks with its eurozone partners.

After the hastily organized video conference, lasting more than two hours on Saturday, the 17 eurozone finance ministers issued a statement saying they were “willing to respond favourably” to a Spanish plea for help.

The deal – hailed by European economic powerhouse Germany and the United States as well as the IMF – marks a dramatic climbdown for Spain, where successive governments have hotly denied any need for outside aid.

Prime Minister Mariano Rajoy’s conservative government finally bowed to pressure from world leaders and, more importantly, the markets, which have sent Spanish borrowing costs soaring.

Defying all efforts by policymakers, the eurozone emergency has now spread to the region’s fourth-biggest economy – Spain’s is twice the size of those of Greece, Ireland and Portugal combined.

“The Spanish government declares its intention to solicit European financial help for the recapitalisation of those banks that need it,” a visibly tense Economy Minister Luis de Guindos told a news conference.

De Guindos refused to describe the aid as a rescue deal, which his government had categorically ruled out right up to the last moment.

“This has nothing to do with a rescue,” he insisted, arguing that the aid would be directed to the 30 percent of banks with the greatest exposure to the 2008 property market crash.

The deal imposed no conditions on the overall Spanish economy, and no new austerity measures, de Guindos stressed.

“The only conditions are for the banks,” the finance minister said, conceding however that the deal will further increase Spain’s mushrooming public debt.

Nevertheless, the eurozone ministers said they were confident Spain would honour commitments to cut the deficit and restructure the economy. “Progress in these areas will be closely and regularly reviewed,” they said in the statement.

Spain, which will become the fourth eurozone state to receive financial help since the sovereign debt crisis erupted two years ago, finally sought aid as the cost of buttressing the banks spiralled in past weeks.

Recently nationalized Bankia, which has the largest exposure to the real estate sector, needs 19 billion euros to repair its books.

Under Saturday’s deal, up to 100 billion euros would be provided by the European rescue mechanisms to recapitalise Spanish banks, the eurozone ministers said, providing an “effective backstop” for all possible requirements.

“So we have a new concept. A ‘lite’ bailout with no material conditions on the sovereign and instead merely the banks that apply,” Lloyds Banking Group economist Charles Diebel said in a report.

“This is the latest in the long list of euro measures to stem the crisis. Will it be enough? That’s questionable as it is still prevention rather than cure and again only keeps the banking sector alive rather than really supporting growth.”

The scale of the aid depends on an external audit being carried out for Madrid by consultants Roland Berger and Oliver Wyman. The audit is due by June 21 but de Guindos said it would ready within a few days.

De Guindos stressed that the 100 billion euros included a big safety margin.

“This announcement is good news for the Spanish economy and for the future of the eurozone,” he said.

International Monetary Fund bank stress tests, unveiled Friday three days ahead of schedule, determined that Spanish banks need about 40 billion euros in new capital.

But an IMF official noted that the banks would probably need more than that to build a “credible firewall”.

The assistance is to be channelled through Spain’s state-backed bank Fund for Orderly Bank Restructuring, eurozone policymakers said.

Policymakers hope the rescue will satisfy financial markets and put Spain in a safe harbour ahead of the Greek elections on June 17, which risk leading to a destabilising exit from the eurozone.

German Finance Minister Wolfgang Schaeuble hailed the deal for Spain, saying he and his colleagues welcomed Madrid’s “determination” to recapitalise the banks with “rescue funds”.

His French counterpart Pierre Moscovici called it a good agreement which gives “a very strong signal of solidarity” among Spain’s eurozone partners.

In Washington, IMF managing director Christine Lagarde said she welcomed the Eurogroup decision to provide a “credible backstop” to the Spanish banking system.

US Treasury Secretary Timothy Geithner also welcomed the moves, saying: “These are important for the health of Spain’s economy and as concrete steps on the path to financial union, which is vital to the resilience of the euro area.”