MANILA, Philippines—Most local stocks gained ground for a second straight session on Wednesday as global markets found relief from a better-than-expected US services index and a reported European Union credit line for Spain.

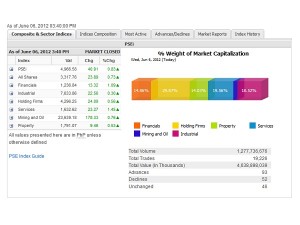

The main-share Philippine Stock Exchange index added 40.91 points, or 0.83 percent, to finish at 4,966.58. All counters went up but the biggest gainers were the financial and services counters, which rose more than 1 percent.

Total value turnover amounted to P4.64 billion. Ninety-three advancers edged out 52 decliners while 46 stocks were unchanged.

The main index was boosted by the gains of AGI (+1.02 percent), DMCI (+2.6 percent), SMIC (+0.89 percent), PLDT (+1.94 percent) and BDO (+4.07 percent). ALI, AEV, Globe, Megaworld, AP, ICTSI, Metrobank and SMC also boosted the PSEi.

Joining the day’s gainers in heavy volume were VMC (+30.06 percent) and East West Bank (+1.5 percent).

On the other hand, the PSEi’s gains were tempered by the decline in URC, SM Prime, AC and EDC.

Newly listed Calata also continued its freefall, giving up 15.22 percent.

“Following an onslaught of disappointing economic news globally, the outcome of the US May ISM non-manufacturing index came as a relief, with the index rising to 53.7 from 53.5. Taken together with reports of a credit line to Spain from Europe’s bailout fund, it left markets in perkier mood overnight,” said investment bank Credit Agricole CIB.

On the other hand, Credit Agricole noted that the emergency G7 conference call on the eurozone turned out to be a “non-event.”

Overnight, the Dow Jones industrial average gained 26.49 points, or 0.22 percent, to 12,127.95 on reports that growth in the US services sector picked up in May as a key indicator of new orders improved. The Institute for Supply Management’s services index edged up to 53.7 in May from 53.5 in April, beating economists’ expectations.