MANILA, Philippines—Infrastructure holding firm Metro Pacific Investments Corp. has raised P8.64 billion in fresh funds for expansion from the sale of shares via a “top-up” private placement.

MPIC sold 2.4 billion shares priced at P3.60 each in a share placement managed by CLSA Ltd. and JP Morgan Securities Ltd. The placement price had a 1.1-percent premium to MPIC’s 30-day volume-weighed averaging closing share price.

Principal stockholder First Pacific Co. Ltd. announced on Friday that its local affiliate Metro Pacific Holdings Inc. had participated in this share placement by subscribing to 1.19 billion MPIC shares valued at P4.29 billion. It now has a 58.6 percent stake in MPIC.

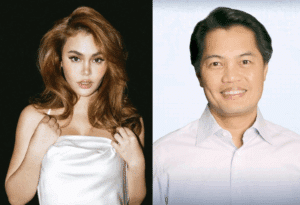

“We have been selling our shareholders and the wider investment community for many months now that MPIC remains a major focus of investment for First Pacific because of the Philippines’ great need for investment in infrastructure and the government’s strong commitment to public-private-partnership to meet this need,” said First Pacific managing director and chief executive officer Manuel V. Pangilinan.

Pangilinan, who is also chair of MPIC, said this share placement was “timely following closely on recent progress on its objective of seeking new toll roads to invest in as well as expanding its current road network.”

A top-up offering means the controlling stockholder has offered and sold shares in MPIC but MPIC will issue the same amount of shares that it sold. By lending its shares, the controlling stockholder has allowed a speedy fund-raising through an equity deal.