PSEi bounces back to 5,000 level

MANILA, Philippines—Local stocks bounced sharply on Thursday, bringing the main index back to the 5,000 level, as risk appetite was boosted by indications that the US Federal Reserve would continue to favor a low-interest rate regime while the recent decline in local share prices attracted fresh buying.

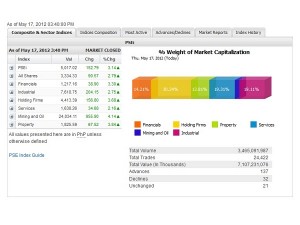

The main-share Philippine Stock Exchange index clawed back 152.79 points, or 3.14 percent, to close at 5,017.02, ending six days of decline.

The rebound was led by the financial, holding firm and property counters, which respectively rose by 3.3 percent, 3.68 percent and 3.84 percent. All counters ended in the green.

Value turnover amounted to P7.1 billion. There were 137 advancers that overwhelmed 32 decliners while 21 stocks were unchanged.

Investors took advantage of the recent decline in prices to pick up shares of index stocks like SMIC, PLDT, DMCI, URC, AGI, BDO, SM Prime, Megaworld, Metrobank, Metro Pacific Investments, Aboitiz Power, Aboitiz Equity, Ayala Corp., Philex, BPI and Manila Water.

Philex Petroleum and Puregold, which were recently added to the MSCI small cap index, rose by 11.78 percent and 5.09 percent, respectively.

Another non-index stocks that gained sharply and in heavy volume was Security Bank (+9.91 percent).

Investment bank Credit Agricole CIB had expected Asian markets to stabilize on Thursday after the heavy sell-off in previous sessions. It said this was “on the back of the dovish FOMC [Federal Open Market Committee] minutes, slightly better-than-expected US data and falling peripheral yields.”

“That said, this respite may not last, given no resolution to the European debt problem. Any rally should provide opportunities to reduce positions,” Credit Agricole CIB said.