MANILA, Philippines—Local stocks slid further on Tuesday, breaking down a key psychological resistance at 5,000, as markets underwent correction while risk aversion rose due to concerns on the economic slowdown in China and recession in Europe.

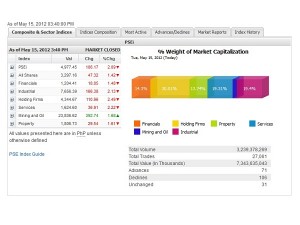

Closing in the red for the fourth straight session, the main-share Philippine Stock Exchange index shed another 106.17 points, or 2.09 percent, to 4,977.45

The hardest hit counters were the industrial, holding firms and services sub-sectors which slumped by over 2 percent.

Juanis Barredo, chief technical strategist at COL Financial, said this was part of a much-awaited correction in the middle of a bull cycle. Barredo had estimated that the Philippine stock market was in the third out of the five “Elliot” waves, said to be the longest and the most grinding phase in such a cycle.

“This is the first part of the correction which may be hitting some good levels. It will be interrupted by a bounce then followed by another selling wave – one that could test the recent lows. A successful hold there should do it,” Barredo said.

He said the PSEi should find a strong support at 4,900. There’s a “small chance” for it to pull back to as deep as the major support level at 4,770.

Value turnover on Tuesday amounted to P7.34 billion. There were 71 advancers, which were edged out by 106 decliners, while 31 stocks were unchanged.

The index was weighed down by PLDT, DMCI, AP, Metrobank, SMIC, AGI, URC, AC, ALI, Megaworld, BPI, ICTSI and MPI. The non-index stocks that fell in heavy volume were Security Bank, GT Capital and Puregold.

On the other hand, the stocks that closed higher for the day were Bloomberry, SM Prime, Benguet “A” and ORE.

Across the region, Asian stocks fell due to concerns on the slowing growth in China. Markets were expecting Europe to report an economic contraction.