Philippine stocks rebound as risk appetite improves

MANILA, Philippines – Local stocks snapped out of a two-day slump on Tuesday as an improved risk appetite across the region allowed the market to reverse a weak start.

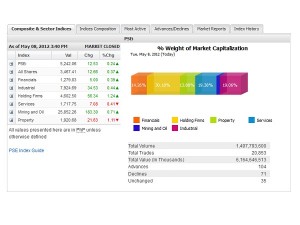

The main-share Philippine Stock Exchange index closed 12.53 points or 0.24 percent higher to 5,242.06.

The local market started out weak despite a generally buoyant regional sentiment but the improved appetite eventually seeped through. The main index was led by the gains of holding firms, whose sub index surged by 1.2 percent. Gains eked out by the financial, industrial and mining/oil also supported the market.

On the other hand, property and services continued to trade in the red. The weaker first quarter results released by telecom players PLDT and Globe Telecom did not excite the market.

Value turnover amounted to P6.16 billion. There were 104 advancers that eclipsed 71 decliners while 35 stocks were unchanged.

Among the index stocks that gained were Megaworld, URC, AC, BPI, ICTSI, Philex, DMCI, MPI and SMIC.

Other stocks that closed higher in heavy trade were Bloomberry, Dizon, Puregold and GT Capital.

On the other hand, PLDT and SM Prime traded in the red. There was likewise profit-taking on newly listed EastWest Bank, whose shares surged on stock trading debut on Monday. Security Bank likewise edged lower.

Across regional markets, sentiment improved on hopes that Spain would intervene to boost its banking system even as concerns over the euro-zone’s fiscal woes remained.